Question: Please show all work and explain each step. DO NOT use Excel. Bella Italia, a famous Italian restaurant, is faced with two independent investment opportunities,

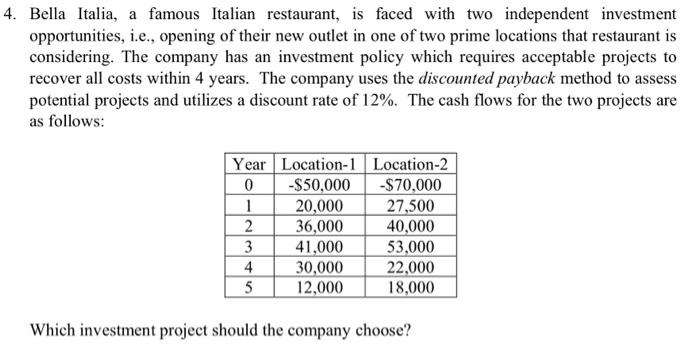

Bella Italia, a famous Italian restaurant, is faced with two independent investment opportunities, i.e., opening of their new outlet in one of two prime locations that restaurant is considering. The company has an investment policy which requires acceptable projects to recover all costs within 4 years. The company uses the discounted payback method to assess potential projects and utilizes a discount rate of 12%. The cash flows for the two projects are as follows: Which investment project should the company choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts