Question: Please show all work and explain if possible Thank you 1) Your firm is interested in entering into a currency swap where it will pay

Please show all work and explain if possible

Thank you

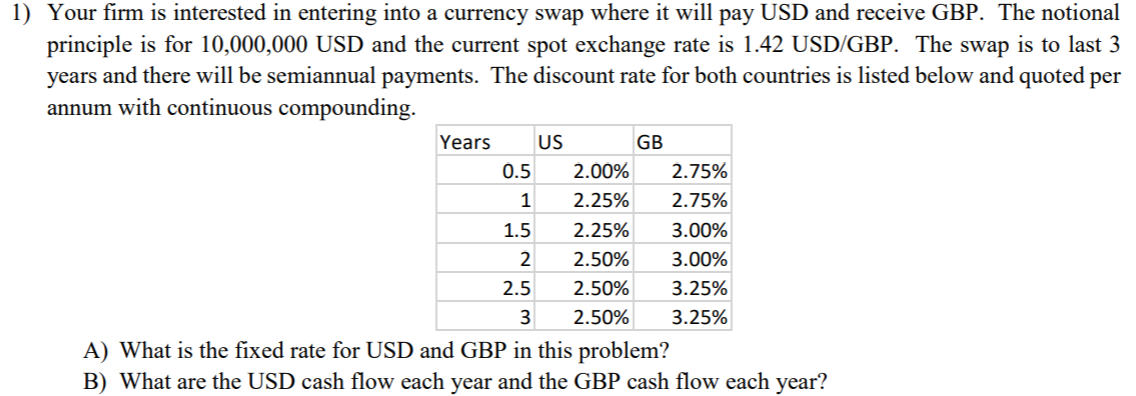

1) Your firm is interested in entering into a currency swap where it will pay USD and receive GBP. The notional principle is for 10,000,000 USD and the current spot exchange rate is 1.42 USD/GBP. The swap is to last 3 years and there will be semiannual payments. The discount rate for both countries is listed below and quoted per annum with continuous compounding. Years US GB 0.5 2.00% 2.75% 1 2.25% 2.75% 1.5 2.25% 3.00% 2 2.50% 3.00% 2.5 2.50% 3.25% 3 2.50% 3.25% A) What is the fixed rate for USD and GBP in this problem? B) What are the USD cash flow each year and the GBP cash flow each year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts