Question: Please show all work and formulas After completing its capital spending for the year, Carlson Manufacturing has $1,400 of extra cash. The company's managers must

Please show all work and formulas

Please show all work and formulas

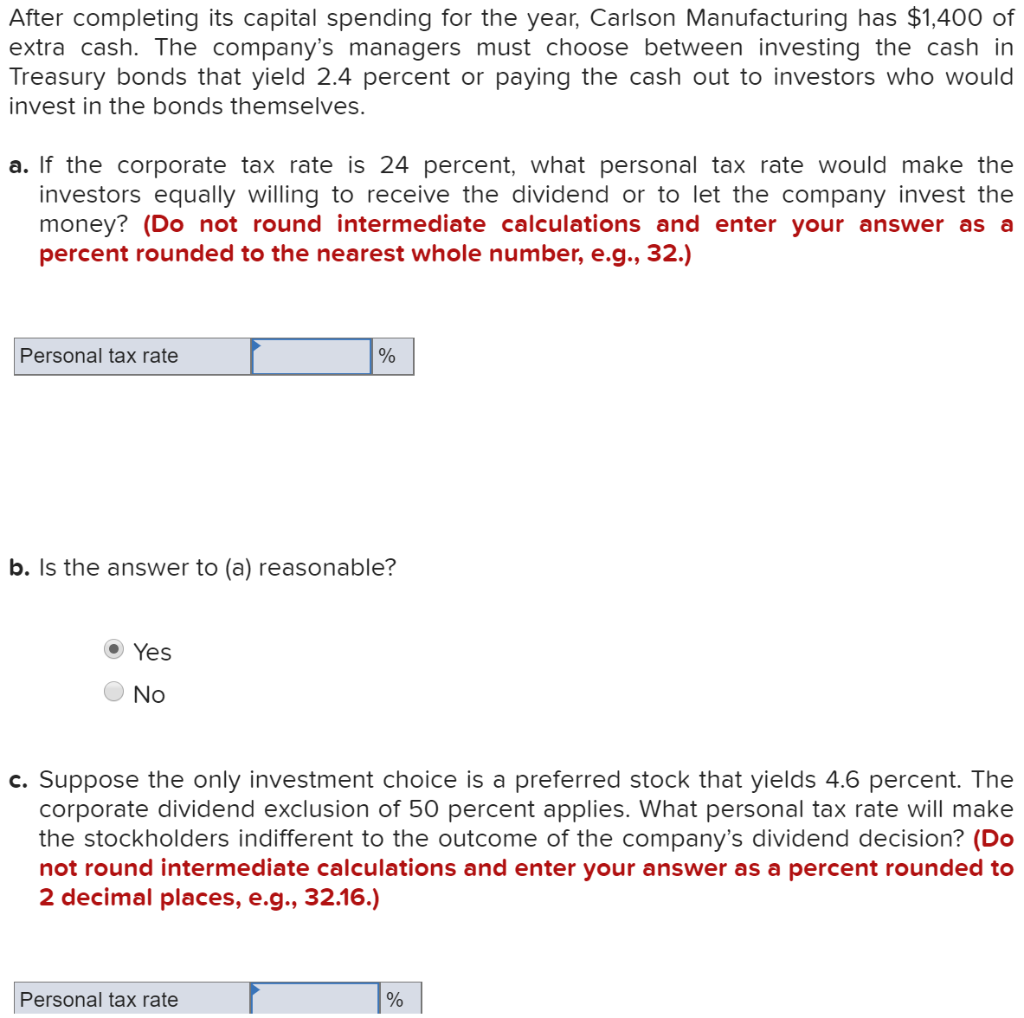

After completing its capital spending for the year, Carlson Manufacturing has $1,400 of extra cash. The company's managers must choose between investing the cash in Treasury bonds that yield 2.4 percent or paying the cash out to investors who would invest in the bonds themselves. a. If the corporate tax rate is 24 percent, what personal tax rate would make the investors equally willing to receive the dividend or to let the company invest the money? (Do not round intermediate calculations and enter your answer as a percent rounded to the nearest whole number, e.g., 32.) Personal tax rate b. Is the answer to (a) reasonable? Yes No c. Suppose the only investment choice is a preferred stock that yields 4.6 percent. The corporate dividend exclusion of 50 percent applies. What personal tax rate will make the stockholders indifferent to the outcome of the company's dividend decision? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Personal tax rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts