Question: Please show all work and formulas in excel please don't use pv fv or any financial calculation please only math in excel 4 $ 6.

Please show all work and formulas in excel please don't use pv fv or any financial calculation please only math in excel

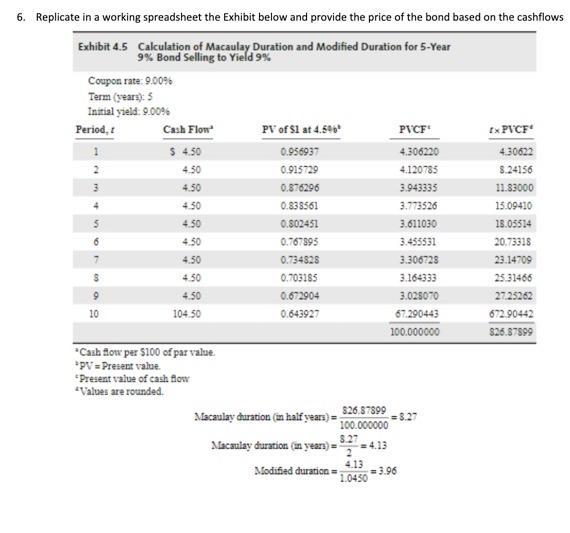

4 $ 6. Replicate in a working spreadsheet the Exhibit below and provide the price of the bond based on the cashflows Exhibit 4.5 Calculation of Macaulay Duration and Modified Duration for 5-Year 9% Bond Selling to Yield 9% Coupon rate: 9.00% Term (years): 5 Initial yield: 0.00% Period, Cash Flow PV of $1 at 4.500 PVCF EX PICF $ 4.50 0.956937 4.306220 4.30622 2 4.50 0.915729 4.120785 8.24156 4.50 0.876296 3.943333 11.83000 4.50 0.838561 3.773526 13.09410 4.50 0.802451 3.611030 18.03514 6 4.50 0.767895 3.433531 20.73315 4.50 0.734528 3.306728 23.14209 4 30 0.703185 3.164333 25.31466 4.50 0.672904 3.025070 2725262 10 104.50 0.643927 67.290443 672.90442 100.000000 826.57899 Caih flow per $100 of par value *PV = Present value. *Present value of cash flow Values are rounded Macaulay duration (in half years) = $26.87899 100.000000 3.27 Macaulay duration in years) = 4.13 Modified duration 1.0450 = 3.96 S 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts