Question: ((PLEASE SHOW ALL WORK AND FORMULAS)) ((PLEASE SHOW ALL WORK AND FORMULAS)) III. Financial Ratio Analysis 22) Below is the balance sheet information on two

((PLEASE SHOW ALL WORK AND FORMULAS))

((PLEASE SHOW ALL WORK AND FORMULAS))

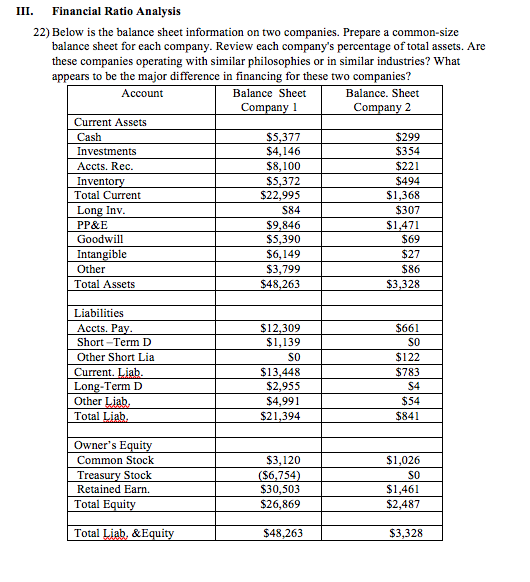

III. Financial Ratio Analysis 22) Below is the balance sheet information on two companies. Prepare a common-size balance sheet for each company. Review each company's percentage of total assets. Are these companies operating with similar philosophies or in similar industries? What appears to be the major difference in financing for these two companies? Account Balance Sheet Balance. Sheet Co Co Current Assets Cash Investments Accts. Rec Invento Total Current Long Inv PP&E Goodwill Intangible Other Total Assets $299 $354 $221 $494 $1,368 $307 $4,146 $8,100 $22,995 S84 $5,390 $6,149 $3,799 $48,263 $69 $27 $86 Liabilities Accts. Pa Short-Term D Other Short Lia Current Long-Term D Other Total S12,309 $1,139 SO S0 $122 $783 S4 $54 $2,955 $4,991 $21,394 Owner's Equi Common Stock Treasury Stock Retained Earn. Total Equit $3,120 (56.754 S26,869 $48,263 $1,026 S0 $1,461 $2,487 Total &Equit $3,328

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts