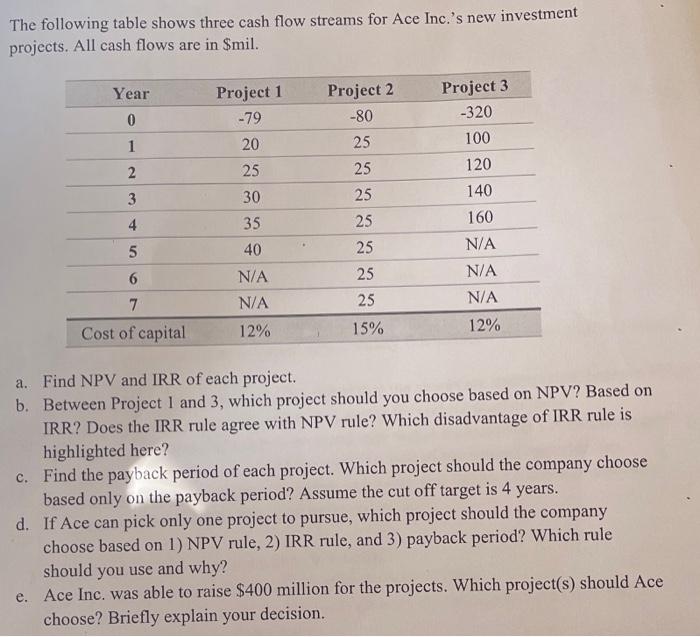

Question: please show all work and formulas The following table shows three cash flow streams for Ace Inc.'s new investment projects. All cash flows are in

The following table shows three cash flow streams for Ace Inc.'s new investment projects. All cash flows are in Smil. Year 0 1 2 3 Project 1 -79 20 25 30 35 40 N/A N/A 12% Project 2 -80 25 25 25 25 Project 3 -320 100 120 140 160 4 5 N/A 25 6 25 N/A N/A 25 7 Cost of capital 15% 12% a. Find NPV and IRR of each project. b. Between Project 1 and 3, which project should you choose based on NPV? Based on IRR? Does the IRR rule agree with NPV rule? Which disadvantage of IRR rule is highlighted here? c. Find the payback period of each project. Which project should the company choose based only on the payback period? Assume the cut off target is 4 years. d. If Ace can pick only one project to pursue, which project should the company choose based on 1) NPV rule, 2) IRR rule, and 3) payback period? Which rule should you use and why? e. Ace Inc. was able to raise $400 million for the projects. Which project(s) should Ace choose? Briefly explain your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts