Question: Please show all work and number each problem correctly! Calculate the total 2014 tax liability for a single parent of one dependent child with a

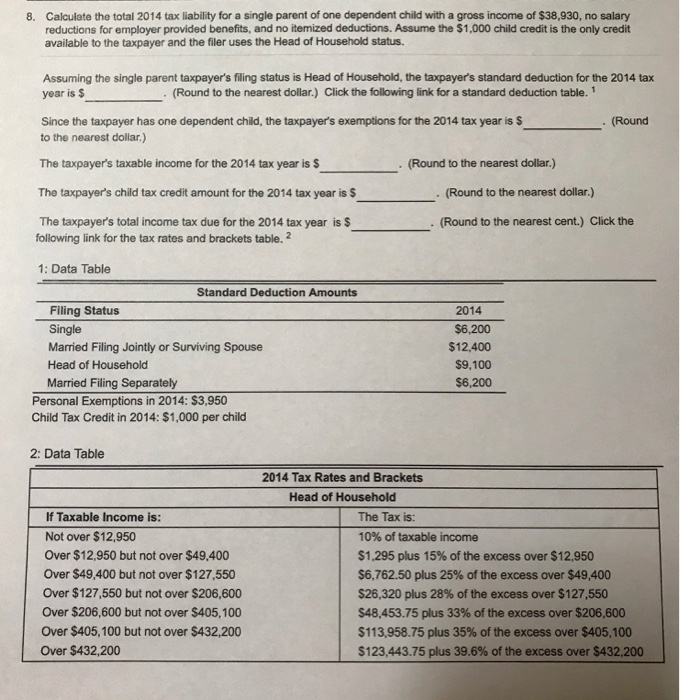

Calculate the total 2014 tax liability for a single parent of one dependent child with a gross income of $38,930, no salary reductions for employer provided benefits, and no itemized deductions. Assume the $1,000 child credit is the only credit available to the taxpayer and the filer uses the Head of Household status. 8. Assuming the single parent taxpayer's filing status is Head of Household, the taxpayers standard deduction for the 2014 tax year is $ (Round to the nearest dollar.) Click the following link for a standard deduction table. 1 Since the taxpayer has one dependent child, the taxpayer's exemptions for the 2014 tax year is to the nearest dollar,) Round S The taxpayer's taxable income for the 2014 tax year is S Round to the nearest dollar.) The taxpayer's child tax credit amount for the 2014 tax year is $ Round to the nearest dollar.) The taxpayer's total income tax due for the 2014 tax year is $ following link for the tax rates and brackets table. 2 Round to the nearest cent.) Click the 1: Data Table Standard Deduction Amounts Filing Status Single Married Filing Jointly or Surviving Spouse Head of Household Married Filing Separately 2014 $6,200 $12,400 $9,100 $6,200 Personal Exemptions in 2014: $3,950 Child Tax Credit in 2014: $1,000 per child 2: Data Table 2014 Tax Rates and Brackets Head of Household If Taxable Income is: Not over $12,950 Over $12,950 but not over $49,400 Over $49,400 but not over $127,550 Over $127,550 but not over $206,600 Over $206,600 but not over $405,100 Over $405,100 but not over $432,200 Over $432,200 The Tax is: 10% of taxable income $1,295 plus 15% of the excess over $12,950 6,762.50 plus 25% of the excess over $49,400 $26,320 plus 28% of the excess over $127,550 $48,453.75 plus 33% of the excess over $206,600 $113,958.75 plus 35% of the excess over $405,100 $123,443.75 plus 39.6% of the excess over $432,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts