Question: (PLEASE SHOW ALL WORK AND VALUES) (PLEASE SHOW ALL WORK AND VALUES) 3) The State of Confusion wants to change the current retirement policy for

(PLEASE SHOW ALL WORK AND VALUES)

(PLEASE SHOW ALL WORK AND VALUES)

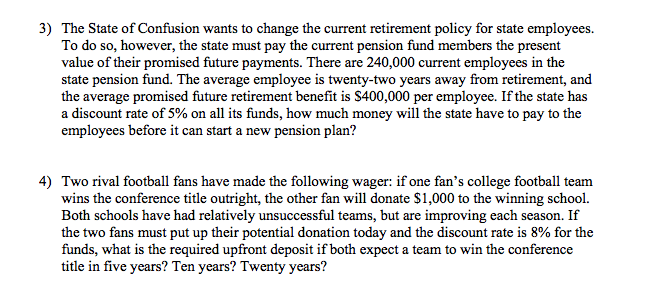

3) The State of Confusion wants to change the current retirement policy for state employees. To do so, however, the state must pay the current pension fund members the present value of their promised future payments. There are 240,000 current employees in the state pension fund. The average employee is twenty-two years away from retirement, and the average promised future retirement benefit is S400,000 per employee. If the state has a discount rate of 5% on all its funds, how much money will the state have to pay to the employees before it can start a new pension plan? 4) Two rival football fans have made the following wager: if one fan's college football team wins the conference title outright, the other fan will donate S1,000 to the winning school. Both schools have had relatively unsuccessful teams, but are improving each season. If the two fans must put up their potential donation today and the discount rate is 8% for the funds, what is the required upfront deposit if both expect a team to win the conference title in five years? Ten years? Twenty years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts