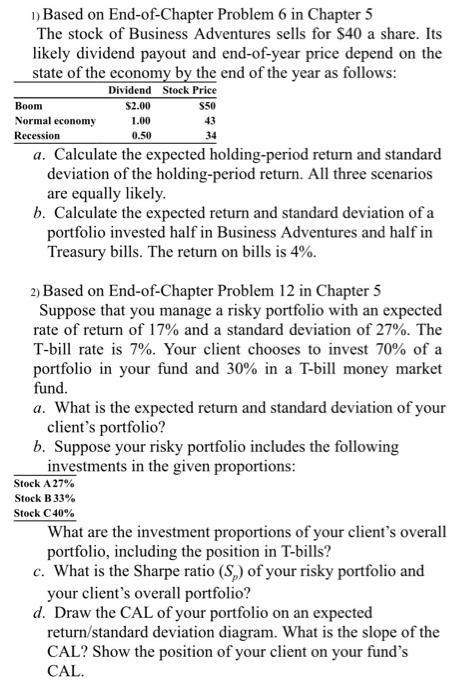

Question: please show all work Boom Normal economy 1) Based on End-of-Chapter Problem 6 in Chapter 5 The stock of Business Adventures sells for $40 a

Boom Normal economy 1) Based on End-of-Chapter Problem 6 in Chapter 5 The stock of Business Adventures sells for $40 a share. Its likely dividend payout and end-of-year price depend on the state of the economy by the end of the year as follows: Dividend Stock Price $2.00 $50 1.00 Recession 0.50 a. Calculate the expected holding-period return and standard deviation of the holding-period return. All three scenarios are equally likely. b. Calculate the expected return and standard deviation of a portfolio invested half in Business Adventures and half in Treasury bills. The return on bills is 4%. 43 34 2) Based on End-of-Chapter Problem 12 in Chapter 5 Suppose that you manage a risky portfolio with an expected rate of return of 17% and a standard deviation of 27%. The T-bill rate is 7%. Your client chooses to invest 70% of a portfolio in your fund and 30% in a T-bill money market fund. a. What is the expected return and standard deviation of your client's portfolio? b. Suppose your risky portfolio includes the following investments in the given proportions: Stock A 27% Stock B 33% Stock C 40% What are the investment proportions of your client's overall portfolio, including the position in T-bills? c. What is the Sharpe ratio (Sp) of your risky portfolio and your client's overall portfolio? d. Draw the CAL of your portfolio on an expected return/standard deviation diagram. What is the slope of the CAL? Show the position of your client on your fund's CAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts