Question: please show all work (clear) i need number 2 and 3 thank you in advance! u pone On January 1, 2018. Forrest Manufacturing Company purchased

please show all work (clear) i need number 2 and 3 thank you in advance!

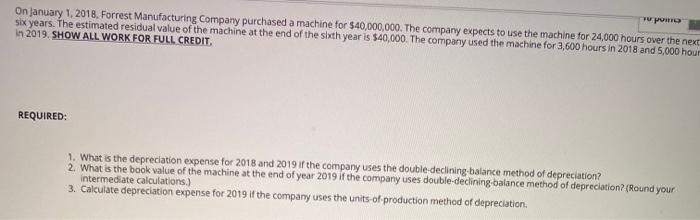

please show all work (clear) i need number 2 and 3 thank you in advance!u pone On January 1, 2018. Forrest Manufacturing Company purchased a machine for $40,000,000. The company expects to use the machine for 24,000 hours over the next six years. The estimated residual value of the machine at the end of the sixth year is $40,000. The company used the machine for 3,600 hours in 2018 and 5,000 hour in 2019. SHOW ALL WORK FOR FULL CREDIT REQUIRED: 1. What is the depreciation expense for 2018 and 2019 if the company uses the double declining balance method of depreciation? 2. What is the book value of the machine at the end of year 2019 if the company uses double-declining balance method of depreciation (Round your intermediate calculations.) 3. Calculate depreciation expense for 2019 if the company uses the units of production method of depreciation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts