Question: Please show all work. Correct answer is highlighted. Use this information for the next 4 questions: Consider the following information for VOL, Inc. (in millions,

Please show all work. Correct answer is highlighted.

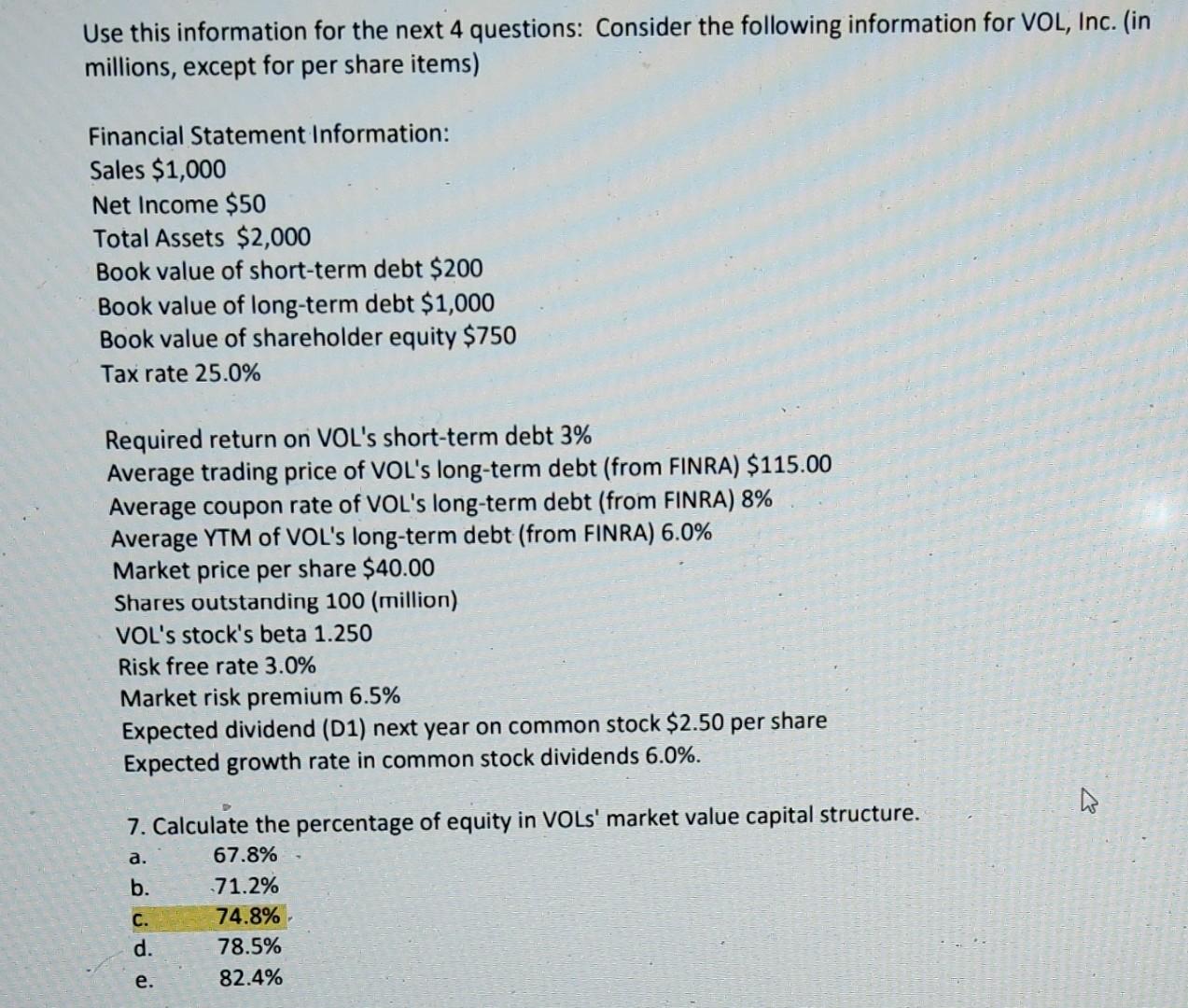

Use this information for the next 4 questions: Consider the following information for VOL, Inc. (in millions, except for per share items) Financial Statement Information: Sales $1,000 Net Income $50 Total Assets \$2,000 Book value of short-term debt $200 Book value of long-term debt $1,000 Book value of shareholder equity $750 Tax rate 25.0% Required return on VOL's short-term debt 3% Average trading price of VOL's long-term debt (from FINRA) \$115.00 Average coupon rate of VOL's long-term debt (from FINRA) 8% Average YTM of VOL's long-term debt (from FINRA) 6.0% Market price per share $40.00 Shares outstanding 100 (million) VOL's stock's beta 1.250 Risk free rate 3.0% Market risk premium 6.5\% Expected dividend (D1) next year on common stock $2.50 per share Expected growth rate in common stock dividends 6.0%. 7. Calculate the percentage of equity in VOLs' market value capital structure. a. 67.8% b. 71.2% c. 74.8% d. 78.5% e. 82.4%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts