Question: PLEASE SHOW ALL WORK!!!!!!! Data table Requirements 1. Calculate the total expected manufacturing cost per unit of making CMCBs in 2018 . 2. Suppose the

PLEASE SHOW ALL WORK!!!!!!!

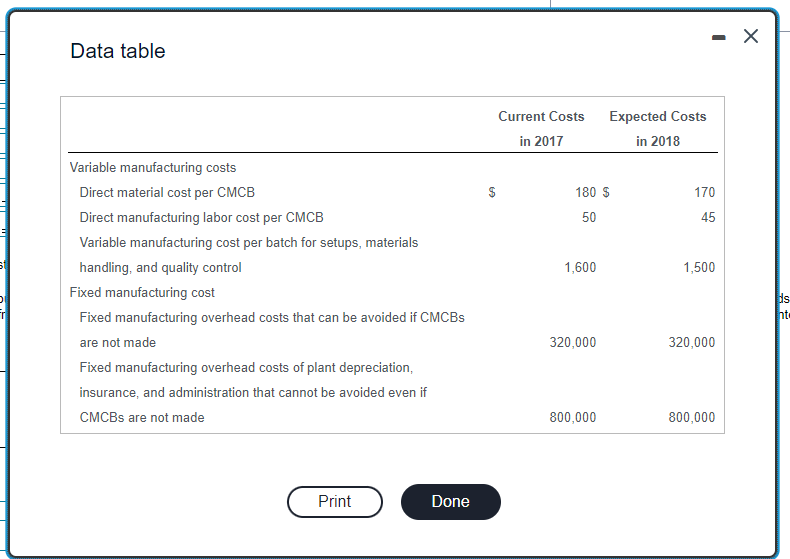

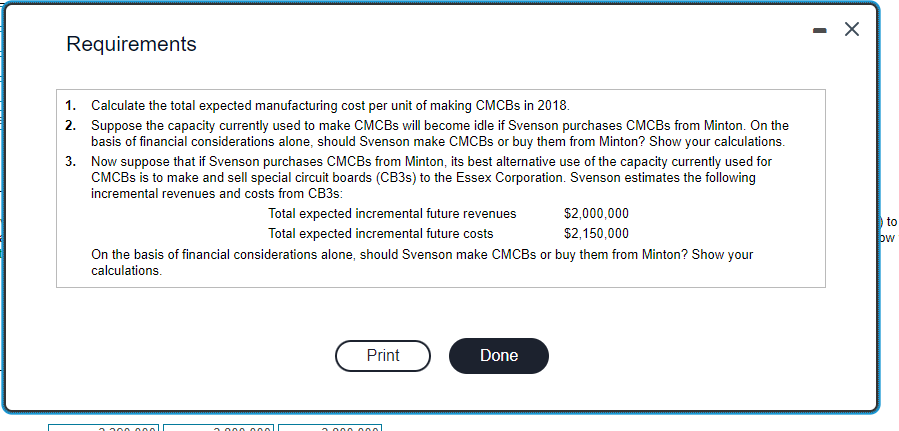

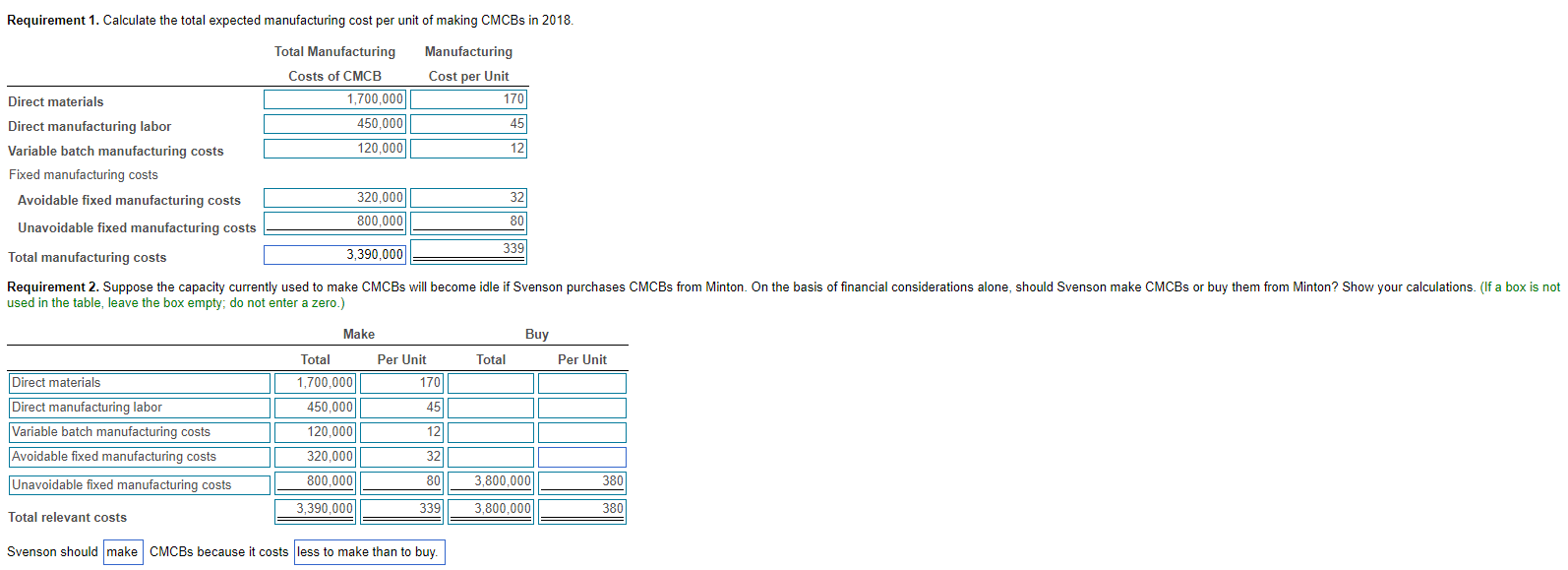

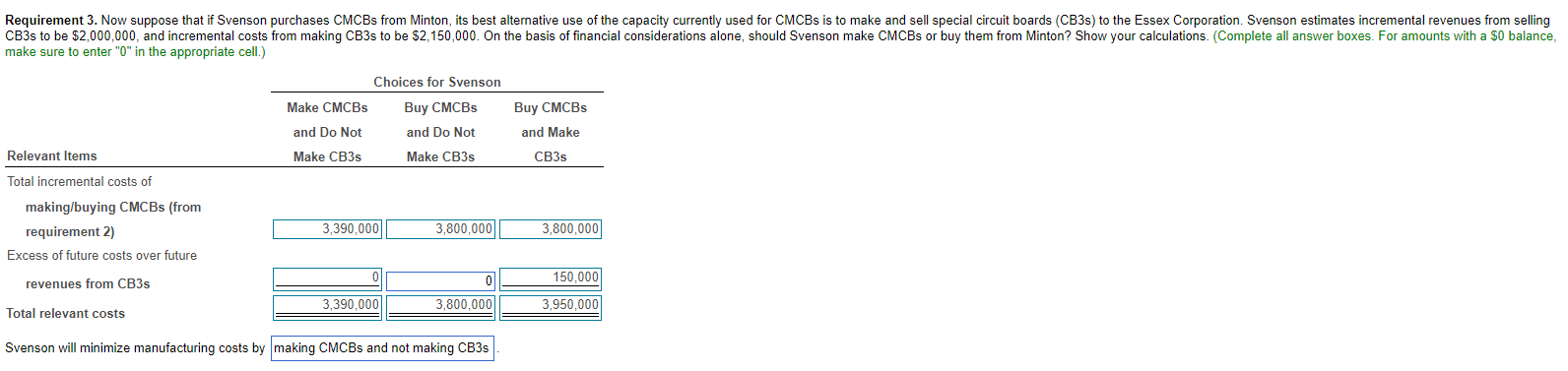

Data table Requirements 1. Calculate the total expected manufacturing cost per unit of making CMCBs in 2018 . 2. Suppose the capacity currently used to make CMCBs will become idle if Svenson purchases CMCBs from Minton. On the basis of financial considerations alone, should Svenson make CMCBs or buy them from Minton? Show your calculations. 3. Now suppose that if Svenson purchases CMCBs from Minton, its best alternative use of the capacity currently used for CMCBs is to make and sell special circuit boards (CB3s) to the Essex Corporation. Svenson estimates the following incremental revenues and costs from CB3s: Total expected incremental future revenues $2,000,000 Total expected incremental future costs $2,150,000 On the basis of financial considerations alone, should Svenson make CMCBs or buy them from Minton? Show your calculations. Requirement 1. Calculate the total expected manufacturing cost per unit of making CMCBs in 2018. make sure to enter " 0 " in the appropriate cell.) Svenson will minimize manufacturing costs by making CMCBs and not making CB3s . Data table Requirements 1. Calculate the total expected manufacturing cost per unit of making CMCBs in 2018 . 2. Suppose the capacity currently used to make CMCBs will become idle if Svenson purchases CMCBs from Minton. On the basis of financial considerations alone, should Svenson make CMCBs or buy them from Minton? Show your calculations. 3. Now suppose that if Svenson purchases CMCBs from Minton, its best alternative use of the capacity currently used for CMCBs is to make and sell special circuit boards (CB3s) to the Essex Corporation. Svenson estimates the following incremental revenues and costs from CB3s: Total expected incremental future revenues $2,000,000 Total expected incremental future costs $2,150,000 On the basis of financial considerations alone, should Svenson make CMCBs or buy them from Minton? Show your calculations. Requirement 1. Calculate the total expected manufacturing cost per unit of making CMCBs in 2018. make sure to enter " 0 " in the appropriate cell.) Svenson will minimize manufacturing costs by making CMCBs and not making CB3s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts