Question: Please show all work done step by step to get answers and how it is input into excel. Assignment Problems 1, ABC Corporation issues a

Please show all work done step by step to get answers and how it is input into excel.

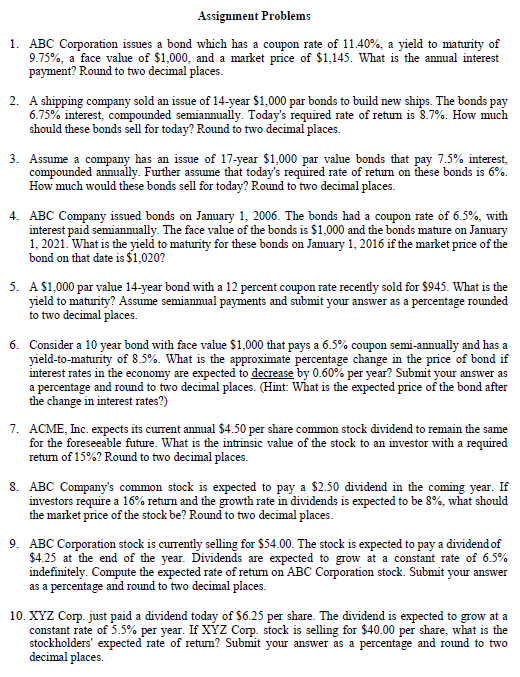

Assignment Problems 1, ABC Corporation issues a bond which has a coupon rate of 11.40%, a yield to maturity of 9.75%, a face value of $1,000, and a market price of $1,145. What is the annual interest payment? Round to two decimal places. 2. A shipping company sold an issue of 14-year $1,000 par bonds to build new ships. The bonds pay 6.75% interest, compounded semiannually. Today's required rate of return is 8.7%. How much should these bonds sell for today? Round to two decimal places. 3. Assume a company has an issue of 17-year $1,000 par value bonds that pay 7.5% interest compounded annually. Further assume that today's required rate of return on these bonds is 6%. How much would these bonds sell for today? Round to two decimal places. 4, ABC Company issued bonds on January 1, 2006. The bonds had a coupon rate of 6.5%, with interest paid semiannually. The face value of the bonds is $1,000 and the bonds mature on Jamuary 1, 2021. What is the yield to maturity for these bonds on January 1, 2016 if the market price of the bond on that date is $1,020? 5. A $1,000 par value 14-year bond with a 12 percent coupon rate recently sold for $945. What is the yield to matrity? Assume semiannual payments and submit your answer as a percentage rounded to two decimal places. 6. Consider a 10 year bond with face value $1,000 that pays a 65% coupon semi-annually and has a yield-to-maturity of 8.5%. What is the approximate percentage change in the price of bond if interest rates in the economy are expected to decrease by 0.60% per year? Submit your answer as a percentage and round to two decimal places. (Hint What is the expected price of the bond after the change in interest rates?) 7. ACME, Inc. expects its curent annual $4.50 per share common stock dividend to remain the same for the foreseeable future. What is the intrinsic value of the stock to an investor with a required retum of 15%? Round to two decimal places. 8. ABC Company's common stock is expected to pay a $2.50 dividend in the coming year. If investors require a 16% return and the growth rate in dividends is expected to be 8%, what should the market price oft he stock be? Round to two decimal places 9. ABC Corporation stock is cuTently selling for $54.00. The stock is expected to pay a dividend of $4.25 at the end of the year. Dividends are expected to grow at a constant rate of 65% indefinitely. Compute the expected rate of return on ABC Corporation stock. Submit your answer as a percentage and round to two decimal places. 10. XYZ Corp. just paid a dividend today of S6.25 per share. The dividend is expected to grow at a constant rate of 55% per year. If XYZ Corp. stock is selling for $40.00 per share, what is the stockholders' expected rate of retum? Submit your answer as a percentage and round to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts