Question: please show all work E16-4 Lump-Sum Liquidation Matthews, Mitchell, and Michaels are partners in BG Land Development Company and share losses in a 5:3:2 ratio,

please show all work

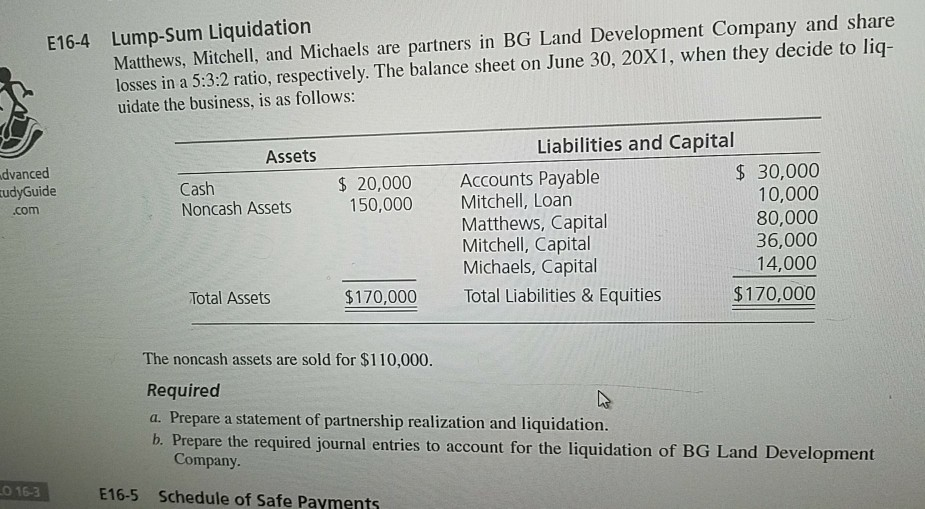

E16-4 Lump-Sum Liquidation Matthews, Mitchell, and Michaels are partners in BG Land Development Company and share losses in a 5:3:2 ratio, respectively. The balance sheet on June 30, 20X1, when they decide to liq- uidate the business, is as follows: Assets Liabilities and Capital dvanced udyGuide .com $30,000 10,000 80,000 36,000 14,000 $170,000 Accounts Payable Cash Noncash Assets 150,000 Mitchell, Loan $20,000 Matthews, Capital Mitchell, Capital Michaels, Capital Total Liabilities & Equities Total Assets $170,000 The noncash assets are sold for $110,000. Required a. Prepare a statement of partnership realization and liquidation. b. Prepare the required journal entries to account for the liquidation of BG Land Development Company. E16-5 Schedule of Safe Payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts