Question: PLEASE SHOW ALL WORK !!! E19.14 (LO 3, 4, 5, 6) (Post-Retirement Benefit Expense, Surplus or Deficit, and Reconcilia- tion) Rosek Inc. provides the following

PLEASE SHOW ALL WORK !!!

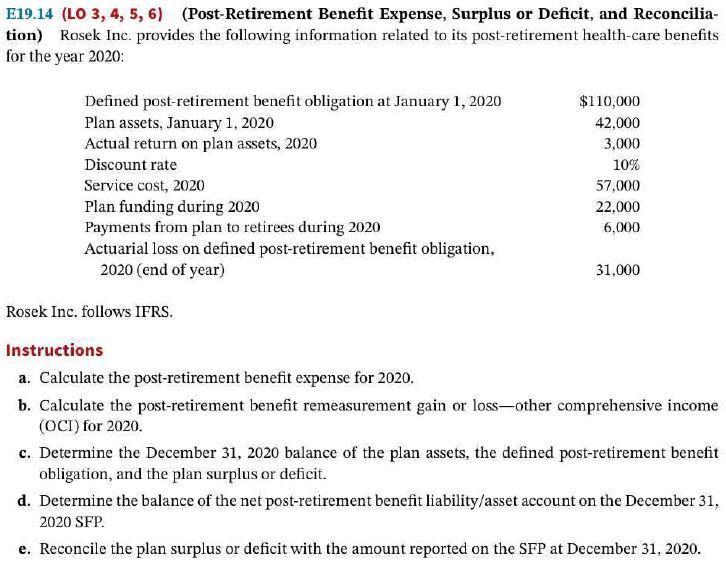

E19.14 (LO 3, 4, 5, 6) (Post-Retirement Benefit Expense, Surplus or Deficit, and Reconcilia- tion) Rosek Inc. provides the following information related to its post-retirement health-care benefits for the year 2020: Defined post-retirement benefit obligation at January 1, 2020 Plan assets, January 1, 2020 Actual return on plan assets, 2020 Discount rate Service cost, 2020 Plan funding during 2020 Payments from plan to retirees during 2020 Actuarial loss on defined post-retirement benefit obligation, 2020 (end of year) $110,000 42,000 3,000 10% 57,000 22.000 6,000 31,000 Rosek Inc. follows IFRS. Instructions a. Calculate the post-retirement benefit expense for 2020. b. Calculate the post-retirement benefit remeasurement gain or loss-other comprehensive income (OCI) for 2020. c. Determine the December 31, 2020 balance of the plan assets, the defined post-retirement benefit obligation, and the plan surplus or deficit. d. Determine the balance of the net post-retirement benefit liability/asset account on the December 31, 2020 SFP e. Reconcile the plan surplus or deficit with the amount reported on the SFP at December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts