Question: please show all work for solution so i can follow along!!! 10-14 Long Haul Trucking (LHT) is evaluating whether to purchase new equipment to service

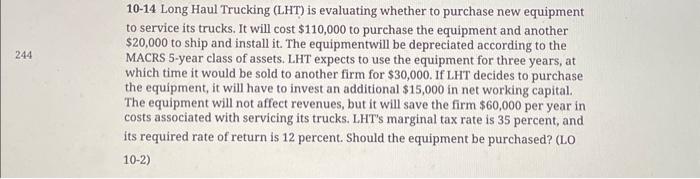

10-14 Long Haul Trucking (LHT) is evaluating whether to purchase new equipment to service its trucks. It will cost $110,000 to purchase the equipment and another $20,000 to ship and install it. The equipmentwill be depreciated according to the MACRS 5-year class of assets. LHT expects to use the equipment for three years, at which time it would be sold to another firm for $30,000. If LHT decides to purchase the equipment, it will have to invest an additional $15,000 in net working capital. The equipment will not affect revenues, but it will save the firm $60,000 per year in costs associated with servicing its trucks. LHT's marginal tax rate is 35 percent, and its required rate of return is 12 percent. Should the equipment be purchased? (LO 102)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts