Question: PLEASE SHOW ALL WORK FOR THE PROBLEM! I do not receive credit unless all work is shown. Thank you! X p. 6 12. (10) For

PLEASE SHOW ALL WORK FOR THE PROBLEM! I do not receive credit unless all work is shown. Thank you!

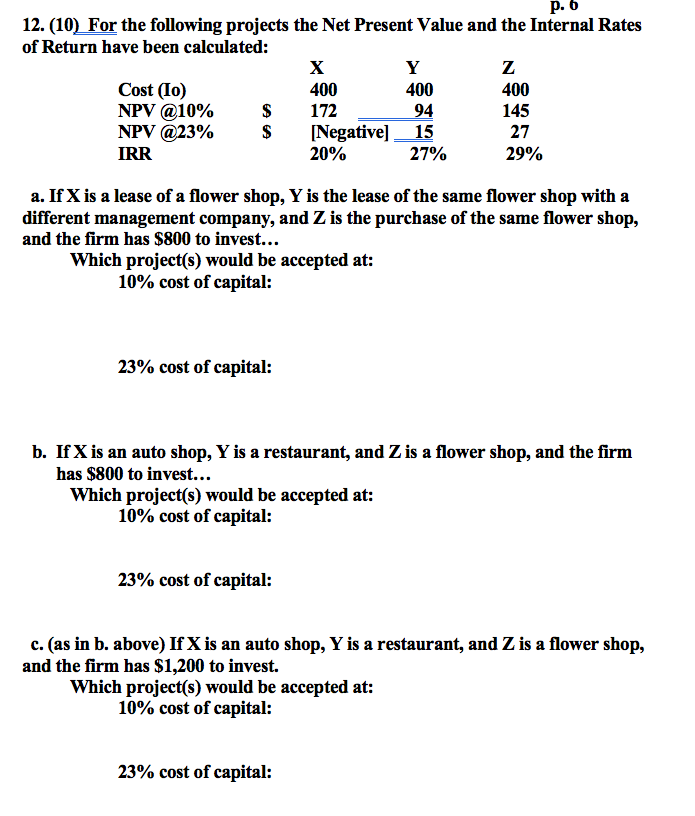

X p. 6 12. (10) For the following projects the Net Present Value and the Internal Rates of Return have been calculated: Y z Cost (10) 400 400 NPV @10% $ 172 94 145 NPV @23% $ [Negative] _15 IRR 20% 27% 29% 400 27 a. If X is a lease of a flower shop, Y is the lease of the same flower shop with a different management company, and Z is the purchase of the same flower shop, and the firm has $800 to invest... Which project(s) would be accepted at: 10% cost of capital: 23% cost of capital: b. If X is an auto shop, Y is a restaurant, and Z is a flower shop, and the firm has $800 to invest... Which project(s) would be accepted at: 10% cost of capital: 23% cost of capital: c. (as in b. above) If X is an auto shop, Y is a restaurant, and Z is a flower shop, and the firm has $1,200 to invest. Which project(s) would be accepted at: 10% cost of capital: 23% cost of capital: X p. 6 12. (10) For the following projects the Net Present Value and the Internal Rates of Return have been calculated: Y z Cost (10) 400 400 NPV @10% $ 172 94 145 NPV @23% $ [Negative] _15 IRR 20% 27% 29% 400 27 a. If X is a lease of a flower shop, Y is the lease of the same flower shop with a different management company, and Z is the purchase of the same flower shop, and the firm has $800 to invest... Which project(s) would be accepted at: 10% cost of capital: 23% cost of capital: b. If X is an auto shop, Y is a restaurant, and Z is a flower shop, and the firm has $800 to invest... Which project(s) would be accepted at: 10% cost of capital: 23% cost of capital: c. (as in b. above) If X is an auto shop, Y is a restaurant, and Z is a flower shop, and the firm has $1,200 to invest. Which project(s) would be accepted at: 10% cost of capital: 23% cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts