Question: Please show all work for the questions including formulas. Thank you!! (1.3) Find the bond's value if the yield for similar bonds decreases to 9%.

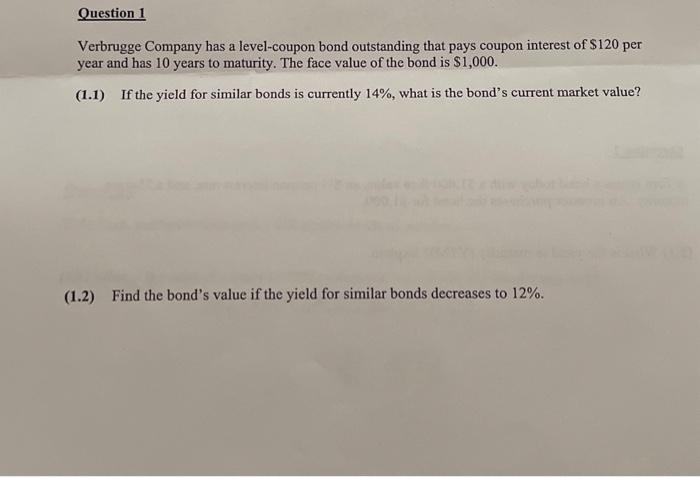

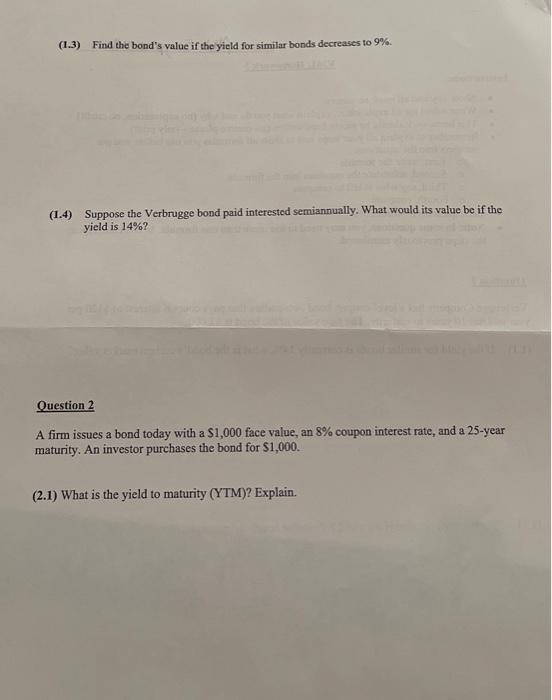

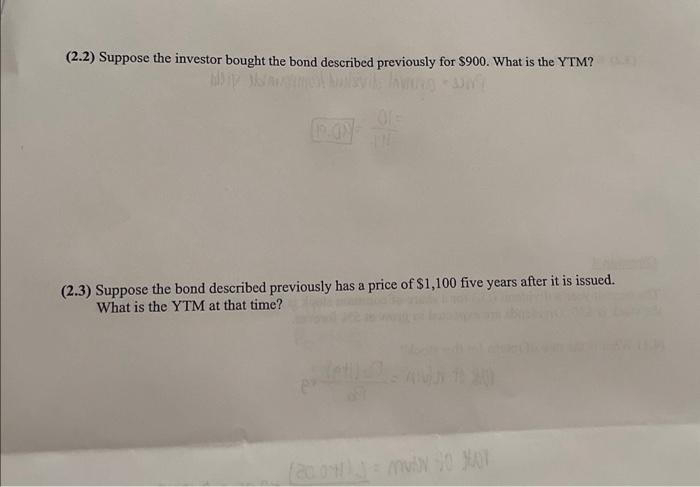

(1.3) Find the bond's value if the yield for similar bonds decreases to 9%. (1.4) Suppose the Verbrugge bond paid interested semiannually. What would its value be if the yield is 14% ? Question 2 A firm issues a bond today with a $1,000 face value, an 8% coupon interest rate, and a 25 -year maturity. An investor purchases the bond for $1,000. (2.1) What is the yield to maturity (YTM)? Explain. Verbrugge Company has a level-coupon bond outstanding that pays coupon interest of $120 per year and has 10 years to maturity. The face value of the bond is $1,000. (1.1) If the yield for similar bonds is currently 14%, what is the bond's current market value? (1.2) Find the bond's value if the yield for similar bonds decreases to 12%. (2.2) Suppose the investor bought the bond described previously for $900. What is the YTM? (2.3) Suppose the bond described previously has a price of $1,100 five years after it is issued. What is the YTM at that time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts