Question: Please show all work for the steps, not just the answer! Thank you! The Information necessary for preparing the 2018 year-end adjusting entries for Vito's

Please show all work for the steps, not just the answer! Thank you!

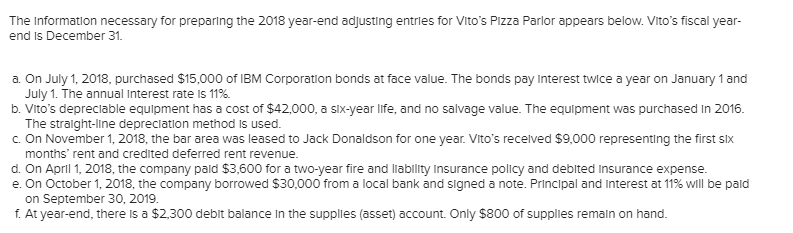

The Information necessary for preparing the 2018 year-end adjusting entries for Vito's Pizza Parlor appears below. Vito's fiscal year- end is December 31. a. On July 1, 2018, purchased $15,000 of IBM Corporation bonds at face value. The bonds pay Interest twice a year on January 1 and July 1. The annual interest rate is 11%. b. Vito's depreciable equipment has a cost of $42.000, a six-year life, and no salvage value. The equipment was purchased In 2016. The straight-lne depreclation method is used. c. On November 1, 2018, the bar area was leased to Jack Donaldson for one year. Vito's recelved $9,000 representing the first stx months rent and credited deferred rent revenue d. On April 1, 2018, the company pald $3,600 for a two-year fire and liablity Insurance policy and deblted Insurance expense. e. On October 1, 2018, the company borrowed $30,000 from a local bank and signed a note. Principal and interest at 11% will be paid on September 30, 2019 f. At year-end, there is a $2.300 debit balance in the supplies (asset) account. Only $800 of supplies remain on hand

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts