Question: Please show all work, formulas, steps, and calculations Project 10, on Chapter 10: Valuations The following rates are most easily estimated annually, but should be

Please show all work, formulas, steps, and calculations

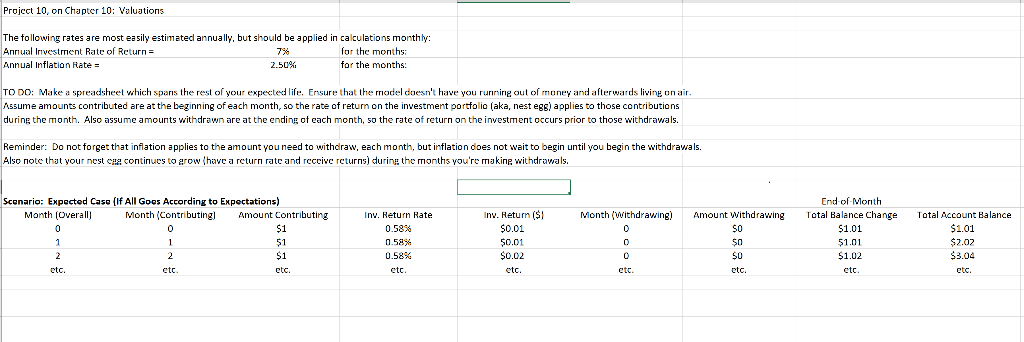

Project 10, on Chapter 10: Valuations The following rates are most easily estimated annually, but should be applied in calculations monthly: Annual Investment Rate of Return= for the months Annual Inflation Rate = 2.50% for the months: TO DO: Make a spreadsheel which spans the rest of your expected life. Ensure that the model doesn't have you running out of money and afterwards living on air. Assume amounts contributed are at the beginning of each month, so the rate of return on the investment portfolio (aka, nest egs) applies to those contributions during the month. Also assume amounts withdrawn are at the ending of each month, so the rate of return on the investment occurs prior to those withdrawals. Reminder: Do not forget that inflation applies to the amount you need to withdraw, each month, but inflation does not wait to begin until you begin the withdrawals. Also note that your nest cea continues to grow have a return rate and receive returns) during the months you're making withdrawals. Scenario: Expected Case (If All Goes According to Expectations) Month (Overall) Month (Contributing) Amount Contributing Month (Withdrawing) Amount withdrawing Inv. Return Rate 0.58% 0.58% 0.58% Inv. Return ($1 $0.01 $0.01 End of Month Total Balance Change $1.01 $1.01 $1.02 etc. Total Account Balance $1.01 $2.02 $3.04 etc. $0.02 etc. etc. etc. etc. etc. etc. etc. Project 10, on Chapter 10: Valuations The following rates are most easily estimated annually, but should be applied in calculations monthly: Annual Investment Rate of Return= for the months Annual Inflation Rate = 2.50% for the months: TO DO: Make a spreadsheel which spans the rest of your expected life. Ensure that the model doesn't have you running out of money and afterwards living on air. Assume amounts contributed are at the beginning of each month, so the rate of return on the investment portfolio (aka, nest egs) applies to those contributions during the month. Also assume amounts withdrawn are at the ending of each month, so the rate of return on the investment occurs prior to those withdrawals. Reminder: Do not forget that inflation applies to the amount you need to withdraw, each month, but inflation does not wait to begin until you begin the withdrawals. Also note that your nest cea continues to grow have a return rate and receive returns) during the months you're making withdrawals. Scenario: Expected Case (If All Goes According to Expectations) Month (Overall) Month (Contributing) Amount Contributing Month (Withdrawing) Amount withdrawing Inv. Return Rate 0.58% 0.58% 0.58% Inv. Return ($1 $0.01 $0.01 End of Month Total Balance Change $1.01 $1.01 $1.02 etc. Total Account Balance $1.01 $2.02 $3.04 etc. $0.02 etc. etc. etc. etc. etc. etc. etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts