Question: please show all work Homework Chapter 12 Question 3 of 4 -/25 13 1 Tyler Gilligan and Matt Melnyk, two college friends, decided to set

please show all work

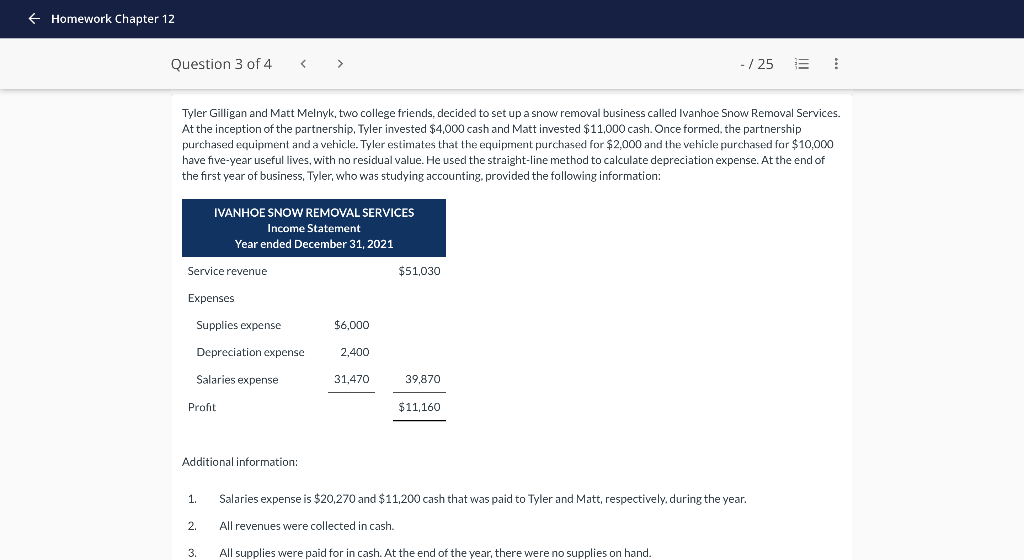

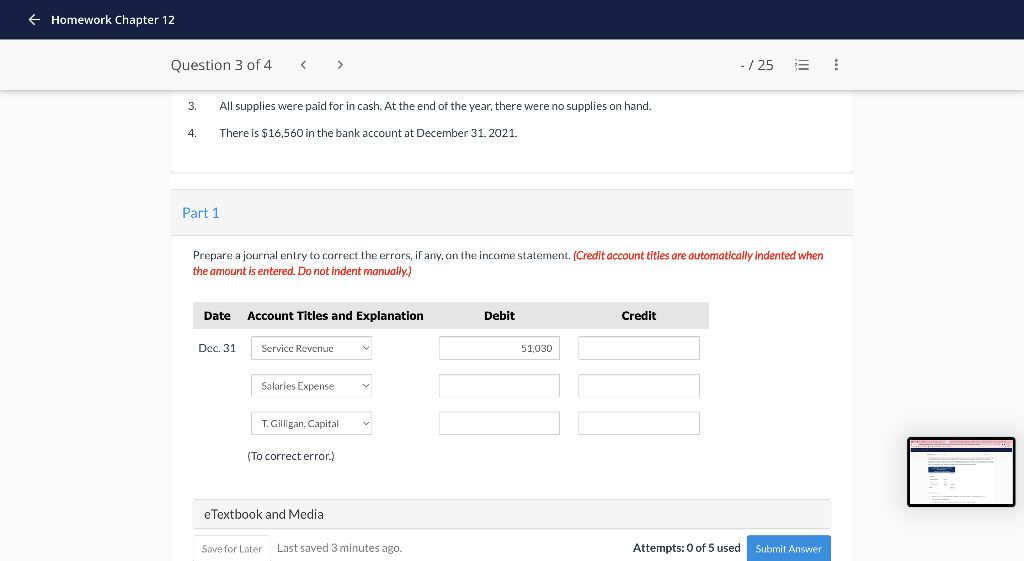

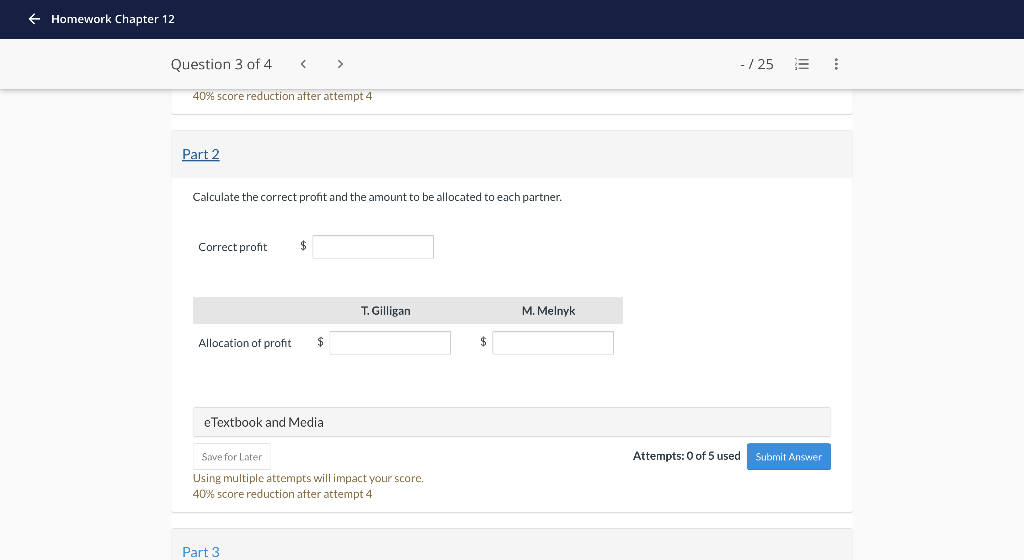

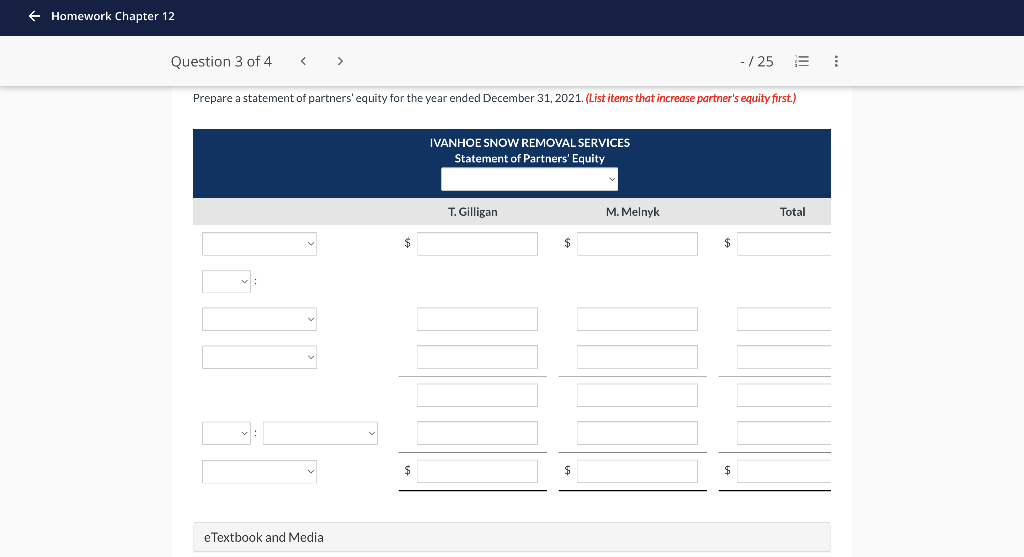

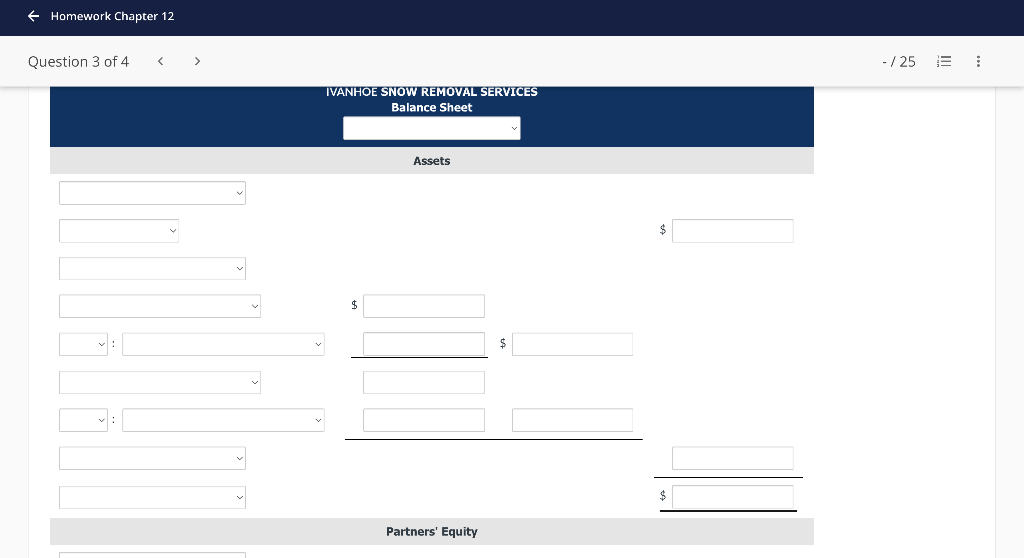

Homework Chapter 12 Question 3 of 4 -/25 13 1 Tyler Gilligan and Matt Melnyk, two college friends, decided to set up a snow removal business called Ivanhoe Snow Removal Services. At the inception of the partnership, Tyler invested $4,000 cash and Matt invested $11,000 cash. Once formed, the partnership purchased equipment and a vehicle. Tyler estimates that the equipment purchased for $2,000 and the vehicle purchased for $10,000 have five-year useful lives, with no residual value. He used the straight-line method to calculate depreciation expense. At the end of the first year of business, Tyler, who was studying accounting, provided the following information: IVANHOE SNOW REMOVAL SERVICES Income Statement Year ended December 31, 2021 Service revenue $51,030 Expenses Supplies expense $6,000 Depreciation expense 2,400 Salaries expense 31,470 39,870 Profit $11,160 Additional information: 1. Salaries expense is $20,270 and $11,200 cash that was paid to Tyler and Matt, respectively, during the year. 2. All revenues were collected in cash. 3. All supplies were paid for in cash. At the end of the year, there were no supplies on hand. Homework Chapter 12 Question 3 of 4 > - /25 3. All supplies were paid for in cash. At the end of the year, there were no supplies on hand. 4. There is $16,560 in the bank account at December 31, 2021. Part 1 Prepare a journal entry to correct the errors, if any, on the income statement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Service Revenue Salaries Expense T.Gilligan, Capital (To correct error.) eTextbook and Media Save for Later Last saved 3 minutes ago. Attempts: 0 of 5 used Submit Answer 51.030 Homework Chapter 12 Question 3 of 4 40% score reduction after attempt 4 Part 2 Calculate the correct profit and the amount to be allocated to each partner. Correct profit $ T.Gilligan M. Melnyk Allocation of profit $ eTextbook and Media Save for Later Using multiple attempts will impact your score. 40% score reduction after attempt 4 Part 3 - /25 Attempts: 0 of 5 used Submit Answer Homework Chapter 12 Question 3 of 4 > -/25 Prepare a statement of partners' equity for the year ended December 31, 2021. (List items that increase partner's equity first.) IVANHOE SNOW REMOVAL SERVICES Statement of Partners' Equity T. Gilligan Total $ $ $ eTextbook and Medial $ $ $ M. Melnyk Homework Chapter 12 Question 3 of 4 > M:[ 10 IVANHOE SNOW REMOVAL SERVICES Balance Sheet Assets Partners' Equity $ $ $ -/25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts