Question: please show all work, I am getting myself super confused with this problem. . Evaluate investment opportunities using various capital budgeting techniques. 1. Josh has

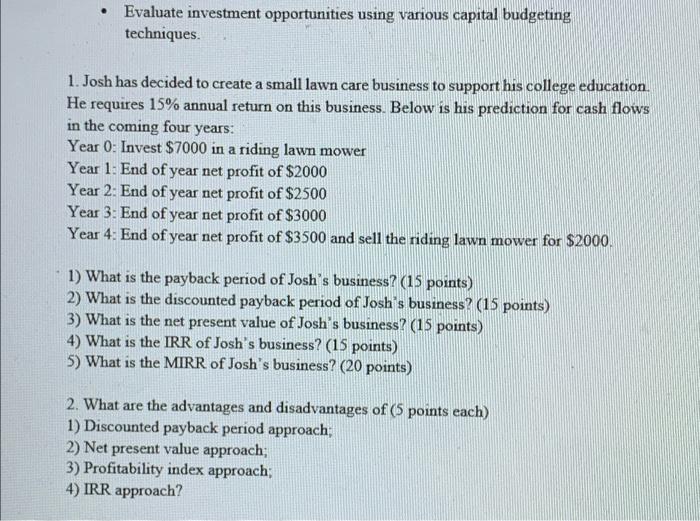

. Evaluate investment opportunities using various capital budgeting techniques. 1. Josh has decided to create a small lawn care business to support his college education. He requires 15% annual return on this business. Below is his prediction for cash flows in the coming four years: Year 0: Invest $7000 in a riding lawn mower Year 1: End of year net profit of $2000 Year 2: End of year net profit of $2500 Year 3: End of year net profit of $3000 Year 4: End of year net profit of $3500 and sell the riding lawn mower for $2000. 1) What is the payback period of Josh's business? (15 points) 2) What is the discounted payback period of Josh's business? (15 points) 3) What is the net present value of Josh's business? (15 points) 4) What is the IRR of Josh's business? (15 points) 5) What is the MIRR of Josh's business? (20 points) 2. What are the advantages and disadvantages of (5 points each) 1) Discounted payback period approach; 2) Net present value approach; 3) Profitability index approach; 4) IRR approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts