Question: Please show all work. I keep getting the wrong answer. The current price of gold is $1956.34 per ounce. The insured storage costs for gold

Please show all work. I keep getting the wrong answer.

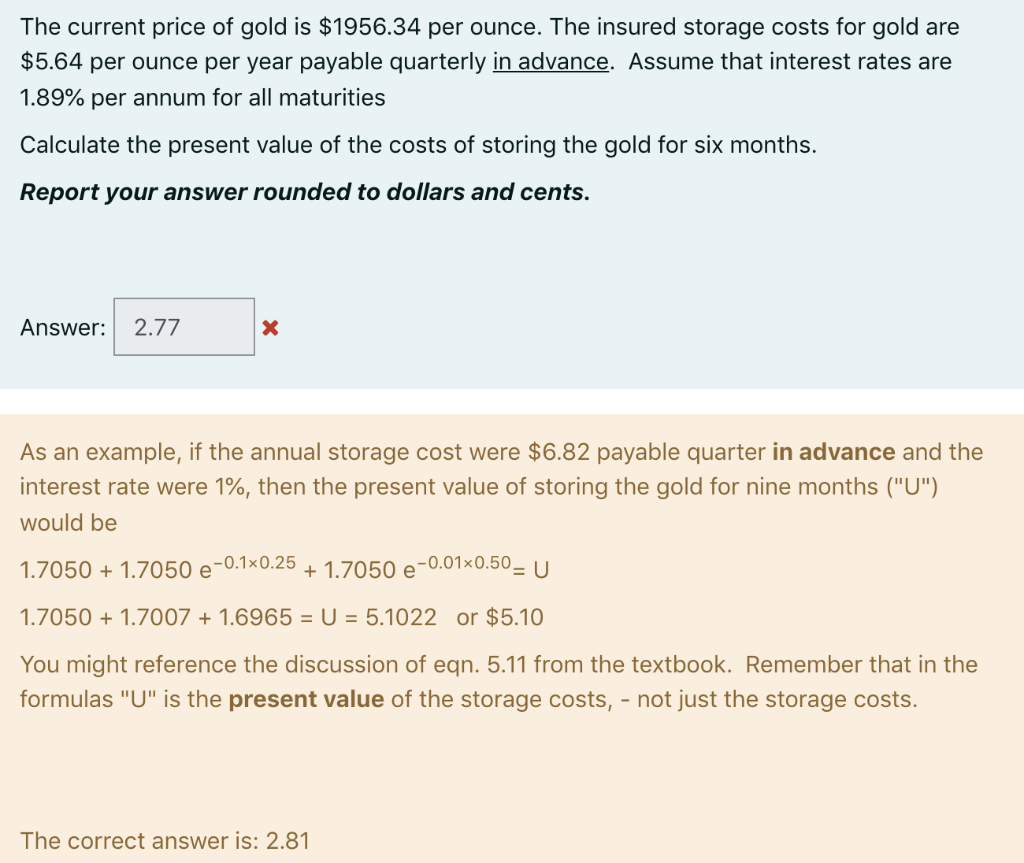

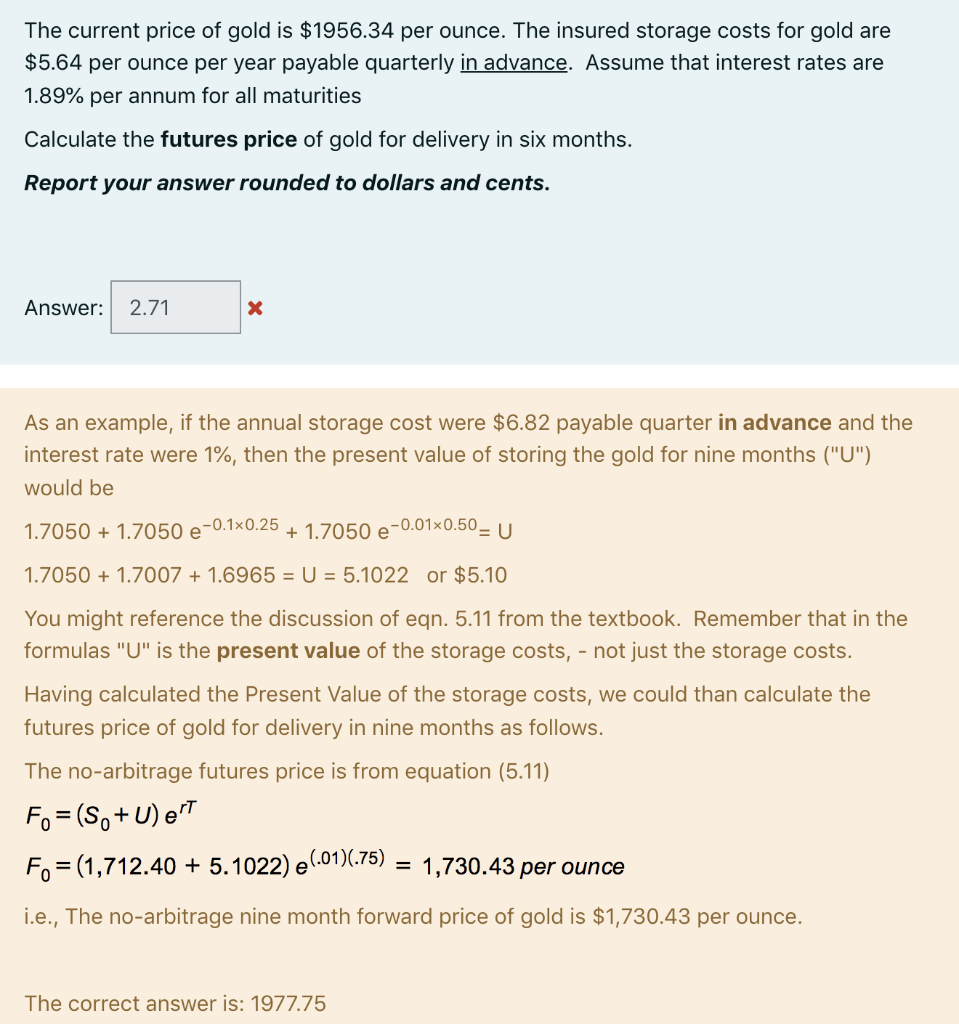

The current price of gold is $1956.34 per ounce. The insured storage costs for gold are $5.64 per ounce per year payable quarterly in advance. Assume that interest rates are 1.89% per annum for all maturities Calculate the present value of the costs of storing the gold for six months. Report your answer rounded to dollars and cents. Answer: 2.77 X As an example, if the annual storage cost were $6.82 payable quarter in advance and the interest rate were 1%, then the present value of storing the gold for nine months ("U") would be 1.7050 + 1.7050 e -0.1*0.25 + 1.7050 e-0.01x0.50 = U e 1.7050 + 1.7007 + 1.6965 = U = 5.1022 or $5.10 You might reference the discussion of eqn. 5.11 from the textbook. Remember that in the formulas "U" is the present value of the storage costs, - not just the storage costs. The correct answer is: 2.81 The current price of gold is $1956.34 per ounce. The insured storage costs for gold are $5.64 per ounce per year payable quarterly in advance. Assume that interest rates are 1.89% per annum for all maturities Calculate the futures price of gold for delivery in six months. Report your answer rounded to dollars and cents. Answer: 2.71 x As an example, if the annual storage cost were $6.82 payable quarter in advance and the interest rate were 1%, then the present value of storing the gold for nine months ("U") would be 1.7050 + 1.7050 -0.1x0.25 + 1.7050 -0.01x0.50 - U + 1.7050 + 1.7007 + 1.6965 = U = 5.1022 or $5.10 You might reference the discussion of eqn. 5.11 from the textbook. Remember that in the formulas "U" is the present value of the storage costs, - not just the storage costs. Having calculated the Present Value of the storage costs, we could than calculate the futures price of gold for delivery in nine months as follows. The no-arbitrage futures price is from equation (5.11) Fo=(So+U) er Fo = (1,712.40 + 5.1022) e(-01).75) 1,730.43 per ounce = i.e., The no-arbitrage nine month forward price of gold is $1,730.43 per ounce. The correct answer is: 1977.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts