Question: Please show all work including formulas. G5 fx D E F H J 1 GODIVA COMPANY IS CONSIDERING REPLACING A 5 YEAR OLD MACHINE THAT

Please show all work including formulas.

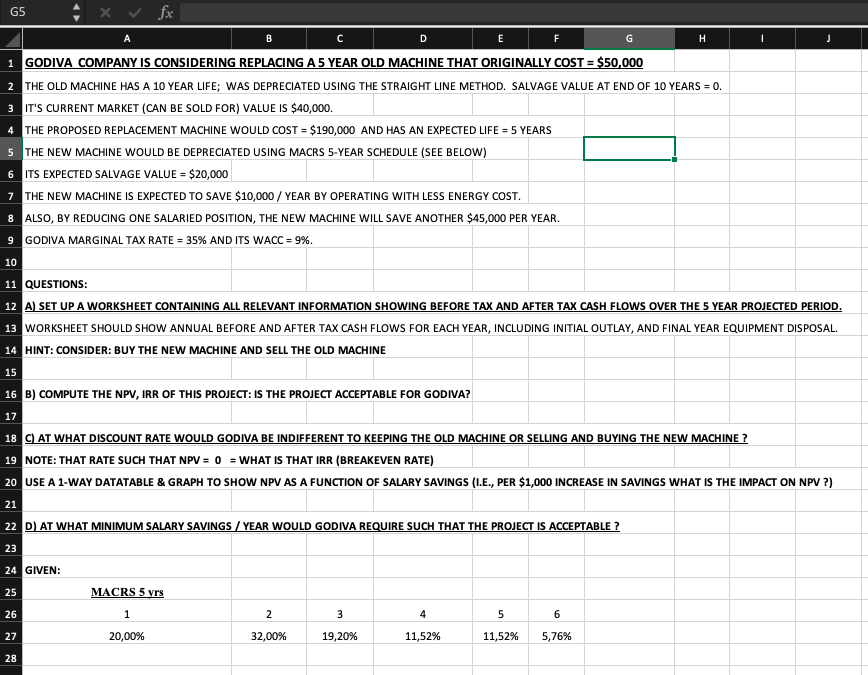

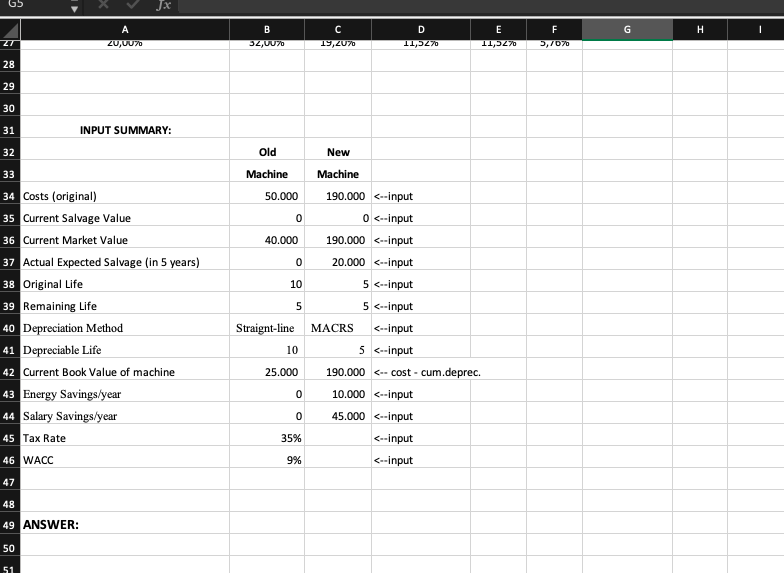

G5 fx D E F H J 1 GODIVA COMPANY IS CONSIDERING REPLACING A 5 YEAR OLD MACHINE THAT ORIGINALLY COST = $50,000 2 THE OLD MACHINE HAS A 10 YEAR LIFE; WAS DEPRECIATED USING THE STRAIGHT LINE METHOD. SALVAGE VALUE AT END OF 10 YEARS = 0. 3 IT'S CURRENT MARKET (CAN BE SOLD FOR) VALUE IS $40,000. 4 THE PROPOSED REPLACEMENT MACHINE WOULD COST = $190,000 AND HAS AN EXPECTED LIFE = 5 YEARS 5 THE NEW MACHINE WOULD BE DEPRECIATED USING MACRS 5-YEAR SCHEDULE (SEE BELOW) 6 ITS EXPECTED SALVAGE VALUE = $20,000 7 THE NEW MACHINE IS EXPECTED TO SAVE $10,000 / YEAR BY OPERATING WITH LESS ENERGY COST. 8 ALSO, BY REDUCING ONE SALARIED POSITION, THE NEW MACHINE WILL SAVE ANOTHER $45,000 PER YEAR. 9 GODIVA MARGINAL TAX RATE = 35% AND ITS WACC = 9%. 10 11 QUESTIONS: 12 A) SET UP A WORKSHEET CONTAINING ALL RELEVANT INFORMATION SHOWING BEFORE TAX AND AFTER TAX CASH FLOWS OVER THE 5 YEAR PROJECTED PERIOD. 13 WORKSHEET SHOULD SHOW ANNUAL BEFORE AND AFTER TAX CASH FLOWS FOR EACH YEAR, INCLUDING INITIAL OUTLAY, AND FINAL YEAR EQUIPMENT DISPOSAL. 14 HINT: CONSIDER: BUY THE NEW MACHINE AND SELL THE OLD MACHINE 15 16 B) COMPUTE THE NPV, IRR OF THIS PROJECT: IS THE PROJECT ACCEPTABLE FOR GODIVA? 17 18 C) AT WHAT DISCOUNT RATE WOULD GODIVA BE INDIFFERENT TO KEEPING THE OLD MACHINE OR SELLING AND BUYING THE NEW MACHINE ? 19 NOTE: THAT RATE SUCH THAT NPV = 0 = WHAT IS THAT IRR (BREAKEVEN RATE) 20 USE A 1-WAY DATATABLE & GRAPH TO SHOW NPV AS A FUNCTION OF SALARY SAVINGS (1.E., PER $1,000 INCREASE IN SAVINGS WHAT IS THE IMPACT ON NPV ?) 21 22 D) AT WHAT MINIMUM SALARY SAVINGS / YEAR WOULD GODIVA REQUIRE SUCH THAT THE PROJECT IS ACCEPTABLE ? 23 24 GIVEN: 25 MACRS 5 yrs 26 1 2 3 4 5 6 27 20,00% 32,00% 19,20% 11,52% 11,52% 5,76% 28 G5 B D H A 20,0070 19,2070 E 11,5270 F 3,7070 ZT 32,0070 11,5270 28 29 30 31 INPUT SUMMARY: 32 33 34 Costs (original) 35 Current Salvage Value 36 Current Market Value 37 Actual Expected Salvage (in 5 years) 38 Original Life 39 Remaining Life 40 Depreciation Method 41 Depreciable Life 42 Current Book Value of machine 43 Energy Savings/year 44 Salary Savings/year 45 Tax Rate old New Machine Machine 50.000 190.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts