Question: Please show all work. Including Formulas. PROBLEM: PENSION SIMULATION SAVINGS ARE INVESTED IN A RISKY ASSET AND A RISK FREE ASSET INPUT PARAMETERS ARE GIVEN

Please show all work. Including Formulas.

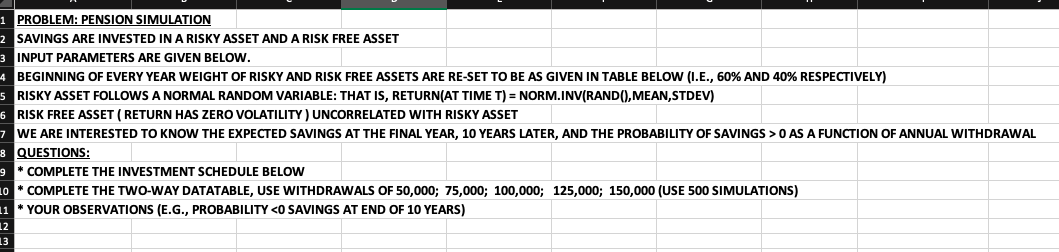

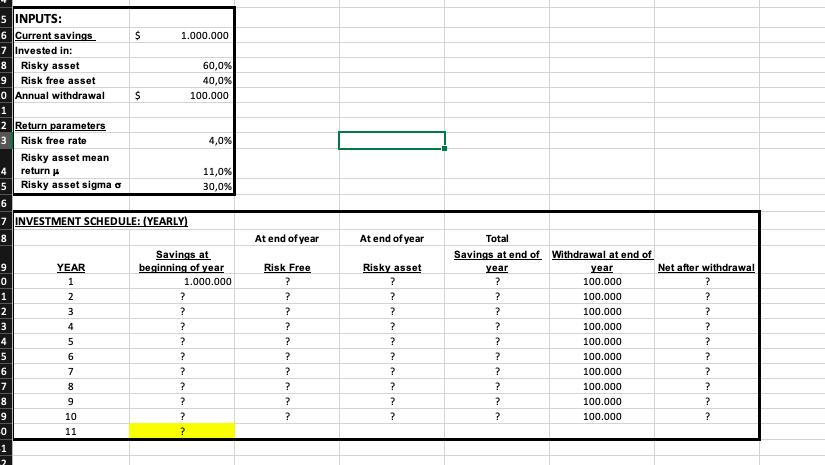

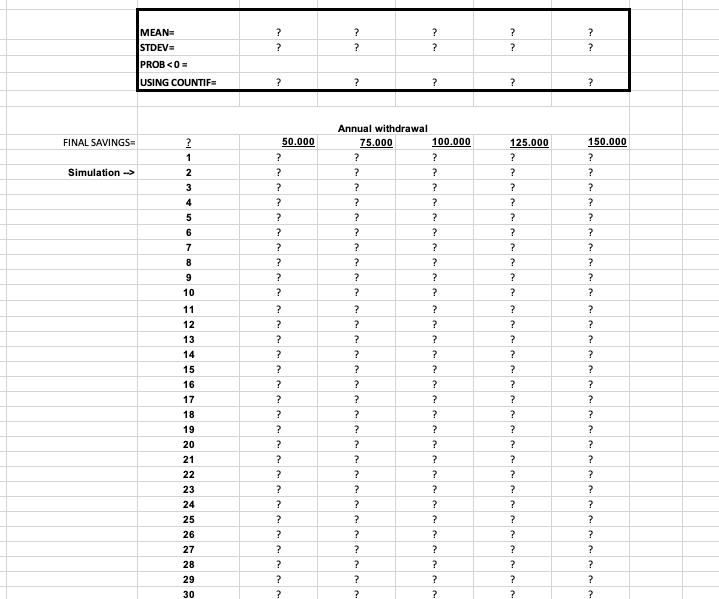

PROBLEM: PENSION SIMULATION SAVINGS ARE INVESTED IN A RISKY ASSET AND A RISK FREE ASSET INPUT PARAMETERS ARE GIVEN BELOW. 4 BEGINNING OF EVERY YEAR WEIGHT OF RISKY AND RISK FREE ASSETS ARE RE-SET TO BE AS GIVEN IN TABLE BELOW (I.E., 60% AND 40% RESPECTIVELY) 5 RISKY ASSET FOLLOWS A NORMAL RANDOM VARIABLE: THAT IS, RETURN(AT TIME T) = NORM.INV(RAND(), MEAN,STDEV) RISK FREE ASSET (RETURN HAS ZERO VOLATILITY) UNCORRELATED WITH RISKY ASSET WE ARE INTERESTED TO KNOW THE EXPECTED SAVINGS AT THE FINAL YEAR, 10 YEARS LATER, AND THE PROBABILITY OF SAVINGS > O AS A FUNCTION OF ANNUAL WITHDRAWAL QUESTIONS: * COMPLETE THE INVESTMENT SCHEDULE BELOW LO * COMPLETE THE TWO-WAY DATATABLE, USE WITHDRAWALS OF 50,000; 75,000; 100,000; 125,000; 150,000 (USE 500 SIMULATIONS) * YOUR OBSERVATIONS (E.G., PROBABILITY ? ? ? ? ? ? ? 50.000 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Annual withdrawal 75.000 100.000 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? 125.000 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? PROBLEM: PENSION SIMULATION SAVINGS ARE INVESTED IN A RISKY ASSET AND A RISK FREE ASSET INPUT PARAMETERS ARE GIVEN BELOW. 4 BEGINNING OF EVERY YEAR WEIGHT OF RISKY AND RISK FREE ASSETS ARE RE-SET TO BE AS GIVEN IN TABLE BELOW (I.E., 60% AND 40% RESPECTIVELY) 5 RISKY ASSET FOLLOWS A NORMAL RANDOM VARIABLE: THAT IS, RETURN(AT TIME T) = NORM.INV(RAND(), MEAN,STDEV) RISK FREE ASSET (RETURN HAS ZERO VOLATILITY) UNCORRELATED WITH RISKY ASSET WE ARE INTERESTED TO KNOW THE EXPECTED SAVINGS AT THE FINAL YEAR, 10 YEARS LATER, AND THE PROBABILITY OF SAVINGS > O AS A FUNCTION OF ANNUAL WITHDRAWAL QUESTIONS: * COMPLETE THE INVESTMENT SCHEDULE BELOW LO * COMPLETE THE TWO-WAY DATATABLE, USE WITHDRAWALS OF 50,000; 75,000; 100,000; 125,000; 150,000 (USE 500 SIMULATIONS) * YOUR OBSERVATIONS (E.G., PROBABILITY ? ? ? ? ? ? ? 50.000 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Annual withdrawal 75.000 100.000 ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? 125.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts