Question: Please show all work Jasmine purchased two assets during the current year. Jasmine placed in service computer equipment (5-year property) on May 20th with a

Please show all work

Please show all work

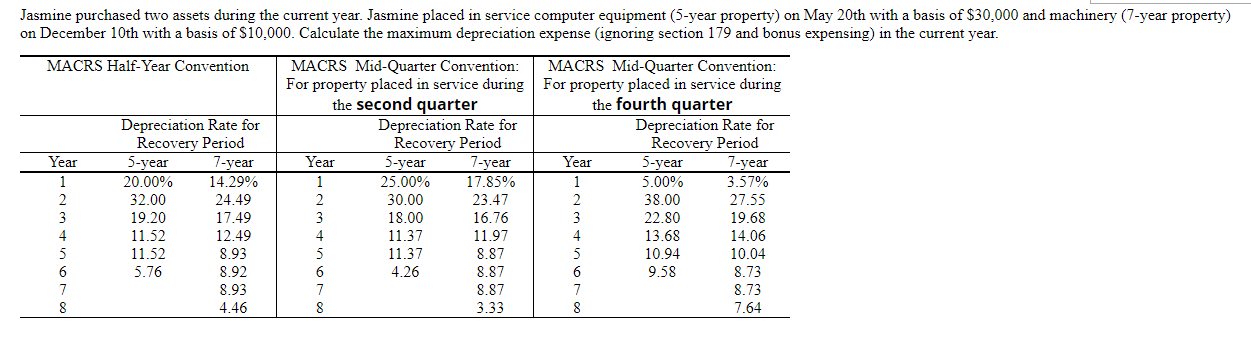

Jasmine purchased two assets during the current year. Jasmine placed in service computer equipment (5-year property) on May 20th with a basis of $30,000 and machinery (7-year property) on December 10th with a basis of $10.000. Calculate the maximum depreciation expense (ignoring section 179 and bonus expensing) in the current year. MACRS Half-Year Convention Depreciation Rate for Recovery Period 5-year 7-year 20.00% 14.29% 32.00 24.49 19.20 17.49 11.52 12.49 11.52 8.93 5.76 8.92 8.93 4.46 Year 1 2 3 4 5 6 7 8 MACRS Mid-Quarter Convention: MACRS Mid-Quarter Convention: For property placed in service during For property placed in service during the second quarter the fourth quarter Depreciation Rate for Depreciation Rate for Recovery Period Recovery Period Year 5-year 7-year Year 5-year 7-year 1 25.00% 17.85% 1 5.00% 3.57% 2 30.00 23.47 2 38.00 27.55 3 18.00 3 22.80 19.68 4 11.37 11.97 4 13.68 14.06 5 11.37 8.87 5 10.94 10.04 6 4.26 8.87 6 9.58 8.73 7 8.87 8.73 8 3.33 8 7.64 16.76

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts