Question: Please show all work! Let's suppose Jin Corporation exported an engine of pickup truck to British A Corporation and billed 10 million payable in one

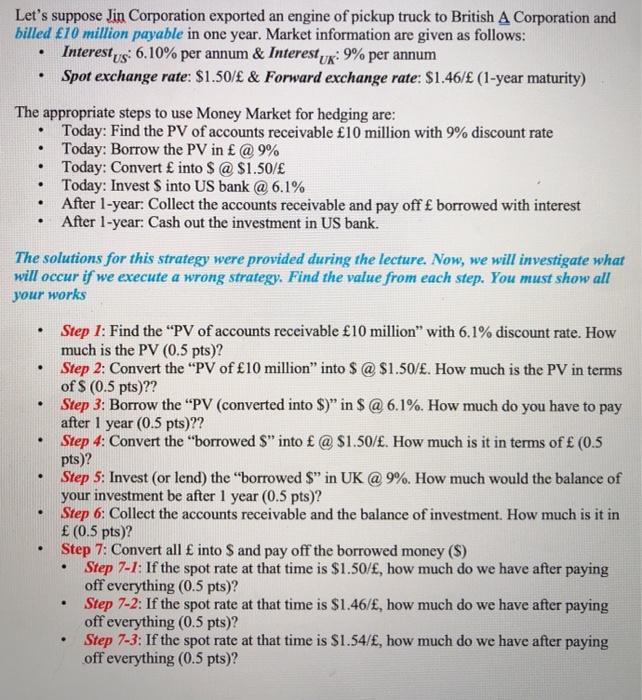

Let's suppose Jin Corporation exported an engine of pickup truck to British A Corporation and billed 10 million payable in one year. Market information are given as follows: Interestus: 6.10% per annum & Interestuk: 9% per annum Spot exchange rate: $1.50/ & Forward exchange rate: $1.46/ (1-year maturity) . . . . . The appropriate steps to use Money Market for hedging are: Today: Find the PV of accounts receivable 10 million with 9% discount rate Today: Borrow the PV in @ 9% Today: Convert into $ @ $1.50/ Today: Invest $ into US bank @ 6.1% After 1-year: Collect the accounts receivable and pay off borrowed with interest After 1-year: Cash out the investment in US bank. The solutions for this strategy were provided during the lecture. Now, we will investigate what will occur if we execute a wrong strategy. Find the value from each step. You must show all your works . . . . . . . Step 1: Find the "PV of accounts receivable 10 million" with 6.1% discount rate. How much is the PV (0.5 pts)? Step 2: Convert the "PV of 10 million" into $ @ $1.50/. How much is the PV in terms of $ (0.5 pts)?? Step 3: Borrow the "PV (converted into $)" in $ @ 6.1%. How much do you have to pay after 1 year (0.5 pts)?? Step 4: Convert the "borrowed $" into @ $1.50/. How much is it in terms of (0.5 pts)? Step 5: Invest (or lend) the "borrowed S in UK @ 9%. How much would the balance of your investment be after 1 year (0.5 pts)? Step 6: Collect the accounts receivable and the balance of investment. How much is it in (0.5 pts)? Step 7: Convert all into $ and pay off the borrowed money (S) Step 7-1: If the spot rate at that time is $1.50/, how much do we have after paying off everything (0.5 pts)? Step 7-2: If the spot rate at that time is $1.46/, how much do we have after paying off everything (0.5 pts)? Step 7-3. If the spot rate at that time is $1.54/, how much do we have after paying off everything (0.5 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts