Question: please show all work neatly will give thumbs up ty :) G 4. A rate of return analysis was conducted for the following alternatives, based

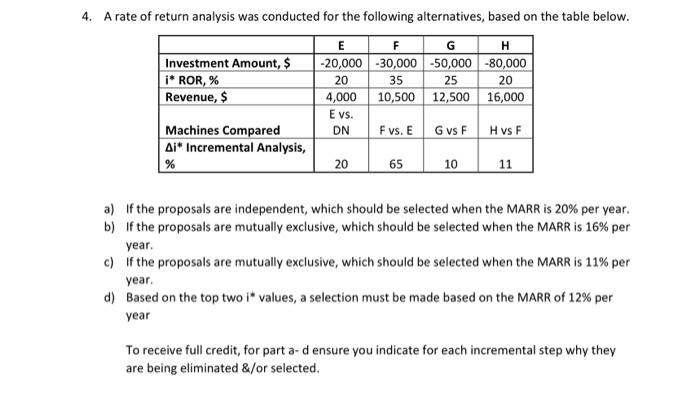

G 4. A rate of return analysis was conducted for the following alternatives, based on the table below. E F H Investment Amount, $ -20,000 -30,000 -50,000 -80,000 i* ROR, % 20 35 25 20 Revenue, $ 4,000 10,500 12,500 16,000 Evs. Machines Compared DN Fvs. E Gvs F Hvs F Ai* Incremental Analysis, % 20 65 10 11 a) If the proposals are independent, which should be selected when the MARR is 20% per year. b) If the proposals are mutually exclusive, which should be selected when the MARR is 16% per year. c) If the proposals are mutually exclusive, which should be selected when the MARR is 11% per year d) Based on the top two i* values, a selection must be made based on the MARR of 12% per year To receive full credit, for part a-d ensure you indicate for each incremental step why they are being eliminated &/or selected. G 4. A rate of return analysis was conducted for the following alternatives, based on the table below. E F H Investment Amount, $ -20,000 -30,000 -50,000 -80,000 i* ROR, % 20 35 25 20 Revenue, $ 4,000 10,500 12,500 16,000 Evs. Machines Compared DN Fvs. E Gvs F Hvs F Ai* Incremental Analysis, % 20 65 10 11 a) If the proposals are independent, which should be selected when the MARR is 20% per year. b) If the proposals are mutually exclusive, which should be selected when the MARR is 16% per year. c) If the proposals are mutually exclusive, which should be selected when the MARR is 11% per year d) Based on the top two i* values, a selection must be made based on the MARR of 12% per year To receive full credit, for part a-d ensure you indicate for each incremental step why they are being eliminated &/or selected

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts