Question: PLEASE SHOW ALL WORK NOT JUST THE ANSWER ONLY DO QUESTION 4 Using this work You want to optimize a portfolio composed of 3 assets.

PLEASE SHOW ALL WORK NOT JUST THE ANSWER

ONLY DO QUESTION 4

Using this work

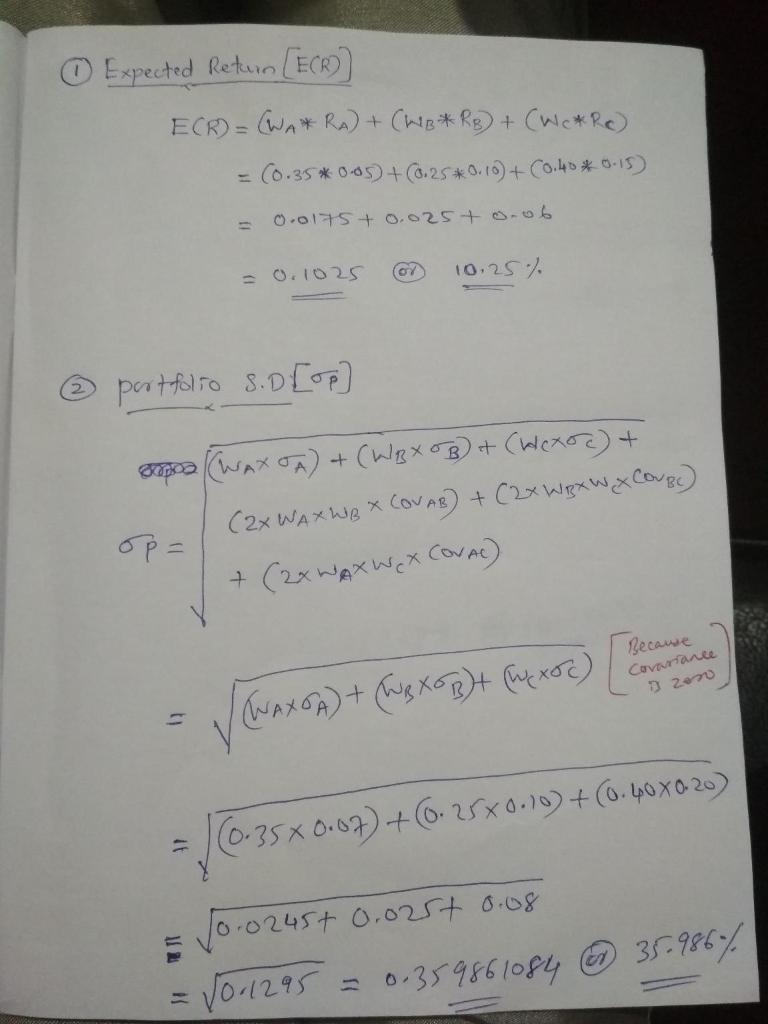

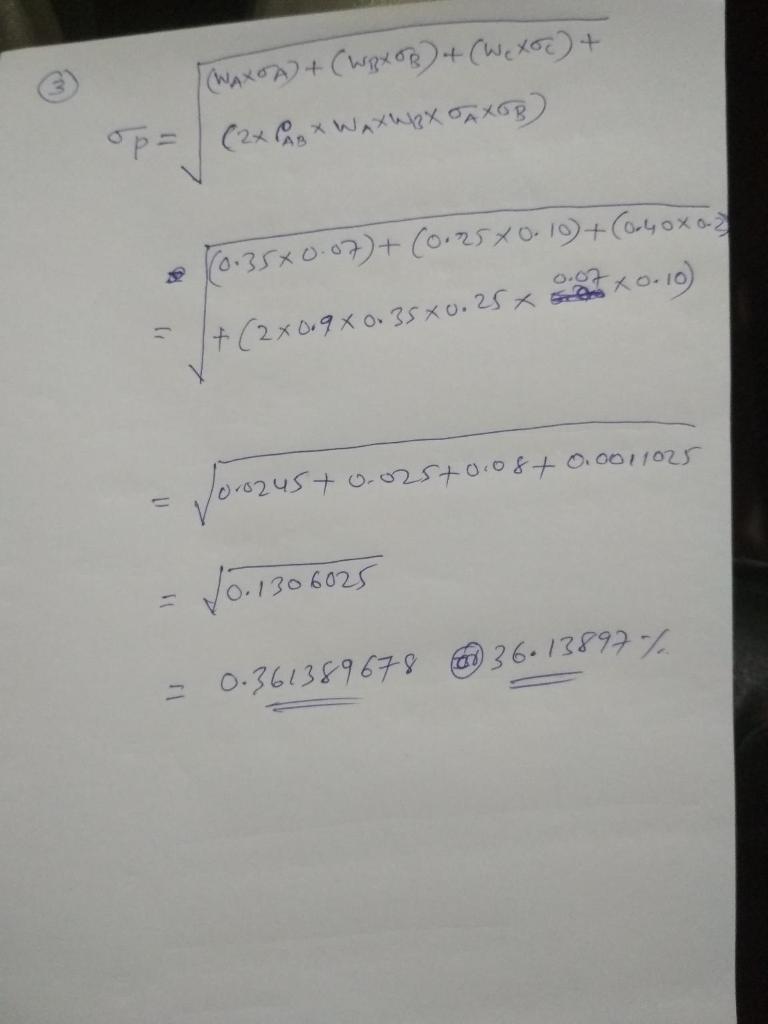

You want to optimize a portfolio composed of 3 assets. These are assets A, B and C. The expected returns are 5%, 10% and 15%, respectively. The standard deviations are 7%, 10%, and 20%.

1. What is the expected return if you invest 35%, 25%, and 40% in assets A, B, and C?

2. What is the standard deviation of the portfolio from the previous point if all the covariances are zero?

3. What is the standard deviation of the portfolio from the previous point if you know all the correlations are zero but the one between assets A and B, which is 0.9? Note you have the correlation not the covariance.

4. Suppose, in the previous exercise, you want to choose the weights optimally to get a 12% expected return. What are all the steps you have to carry out in order to perform this? Describe these steps and set the inputs, outputs and constraints you will need/obtain.

O Expected Return [ECRO) ECR) = (WA*RA) + (WB*RB + (WC&RC) = (0.35*0-05 +6.25*0.10) + C.40*015) 0.0175+ 0.025+ oub = 0.1025 07 10.25% portfolio S.D[op] op= soppa (Wax 0-) + (WBXOB) + (Wexos) + (2x WAX WBX COVAB) + (2x WB X W X COUBE) + (2xWAXWX COVAC) Because Covariance 200 - VENAXEA) + (ws Xog) The xor) =, 0.35%0.09) + 6*25*0:19) + (0-40x020) 10.0245+ 0.025+ 0.08 $0.1295 0.359861084 x 35.986% NAxeA4 (vg on + ( xst) - p= (249x, x ) .. * -3 7)+ (. 19)+(., +(2x c.9 35 xo. 25 ) + nh No. 136 602, ) 36. 1392 = 0.361389678

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts