Question: please show all work on excel ! Excel Online Structured Activity: Interest rate premiums A 5-year Treasury bond has a 4.55% yield. A 10-year Treasury

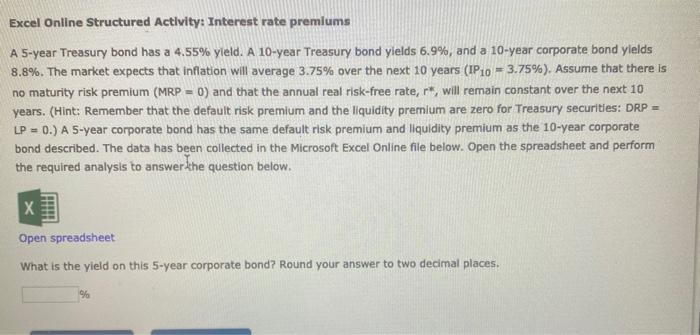

Excel Online Structured Activity: Interest rate premiums A 5-year Treasury bond has a 4.55% yield. A 10-year Treasury bond yields 6.9%, and a 10-year corporate bond yields 8.8%. The market expects that inflation will average 3.75% over the next 10 years (IP 10 = 3.75%). Assume that there is no maturity risk premium (MRP = 0) and that the annual real risk-free rate, r", will remain constant over the next 10 years. (Hint: Remember that the default risk premium and the liquidity premium are zero for Treasury securities: DRP = LP = 0.) A 5-year corporate bond has the same default risk premium and liquidity premium as the 10-year corporate bond described. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet What is the yield on this 5-year corporate bond? Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts