Question: please show all work Please answer the questions in the space provided below each question. Show all of your work and circle your final answer

please show all work

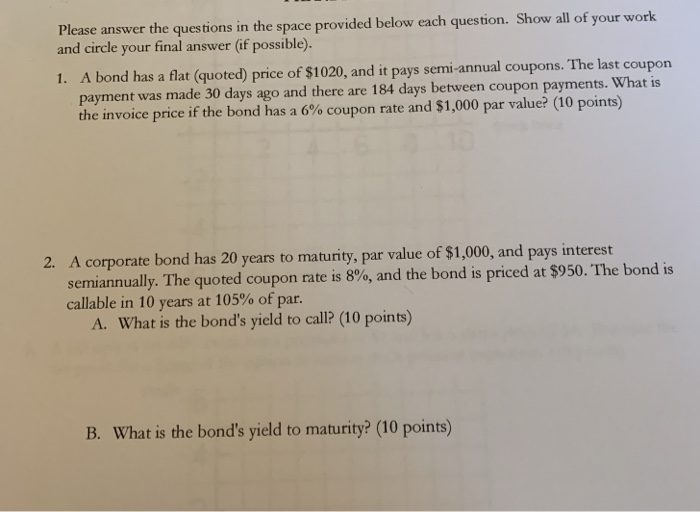

please show all workPlease answer the questions in the space provided below each question. Show all of your work and circle your final answer (if possible). 1. A bond has a flat (quoted) price of $1020, and it pays semi-annual coupons. The last coupon payment was made 30 days ago and there are 184 days between coupon payments. What is the invoice price if the bond has a 6% coupon rate and $1,000 par value? (10 points) 2. A corporate bond has 20 years to maturity, par value of $1,000, and pays interest semiannually. The quoted coupon rate is 8%, and the bond is priced at $950. The bond is callable in 10 years at 105% of par. A. What is the bond's yield to call? (10 points) B. What is the bond's yield to maturity? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts