Question: PLEASE SHOW ALL WORK - PLEASE MAKE IT READABLE - AND PLEASE BE CORRECT. WILL GIVES THUMBS UP! 5. Suppose you are an investment manager

PLEASE SHOW ALL WORK - PLEASE MAKE IT READABLE - AND PLEASE BE CORRECT. WILL GIVES THUMBS UP!

PLEASE SHOW ALL WORK - PLEASE MAKE IT READABLE - AND PLEASE BE CORRECT. WILL GIVES THUMBS UP!

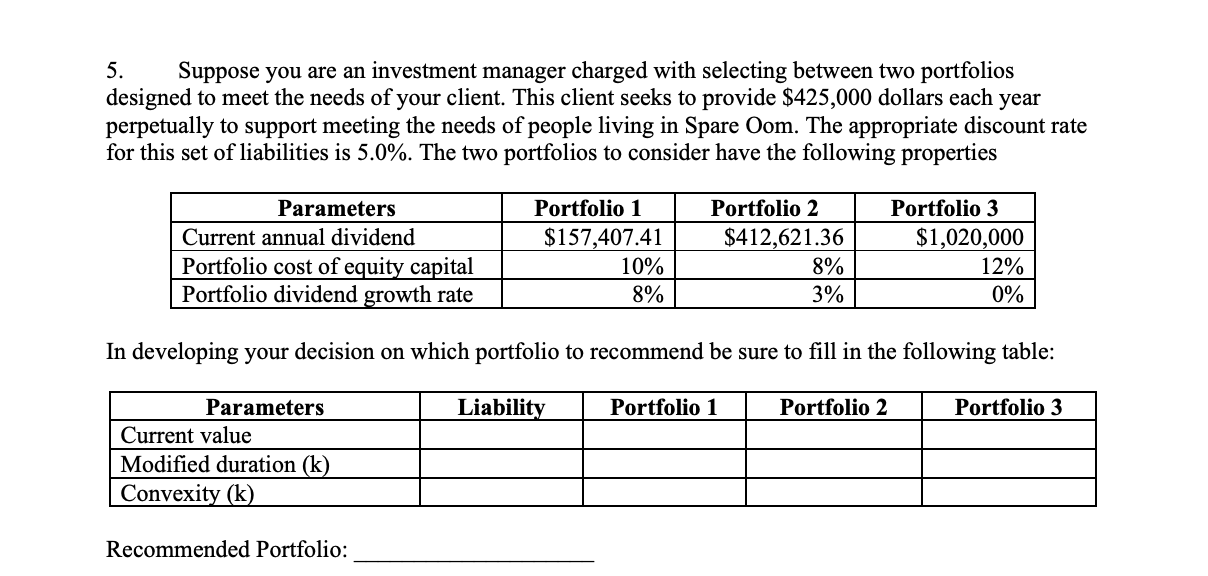

5. Suppose you are an investment manager charged with selecting between two portfolios designed to meet the needs of your client. This client seeks to provide $425,000 dollars each year perpetually to support meeting the needs of people living in Spare Oom. The appropriate discount rate for this set of liabilities is 5.0%. The two portfolios to consider have the following properties Parameters Portfolio 2 Portfolio 3 Portfolio 1 $157,407.41 Current annual dividend $412,621.36 Portfolio cost of equity capital 10% 8% 3% $1,020,000 12% 0% Portfolio dividend growth rate 8% In developing your decision on which portfolio to recommend be sure to fill in the following table: Parameters Liability Portfolio 1 Portfolio 2 Portfolio 3 Current value Modified duration (k) Convexity (k) Recommended Portfolio: 5. Suppose you are an investment manager charged with selecting between two portfolios designed to meet the needs of your client. This client seeks to provide $425,000 dollars each year perpetually to support meeting the needs of people living in Spare Oom. The appropriate discount rate for this set of liabilities is 5.0%. The two portfolios to consider have the following properties Parameters Portfolio 2 Portfolio 3 Portfolio 1 $157,407.41 Current annual dividend $412,621.36 Portfolio cost of equity capital 10% 8% 3% $1,020,000 12% 0% Portfolio dividend growth rate 8% In developing your decision on which portfolio to recommend be sure to fill in the following table: Parameters Liability Portfolio 1 Portfolio 2 Portfolio 3 Current value Modified duration (k) Convexity (k) Recommended Portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts