Question: please show all work. Presented below are the 2018 income statement and comparative balance sheets for Santana Industries. SANTANA INDUSTRIES Income Statement Yor the Year

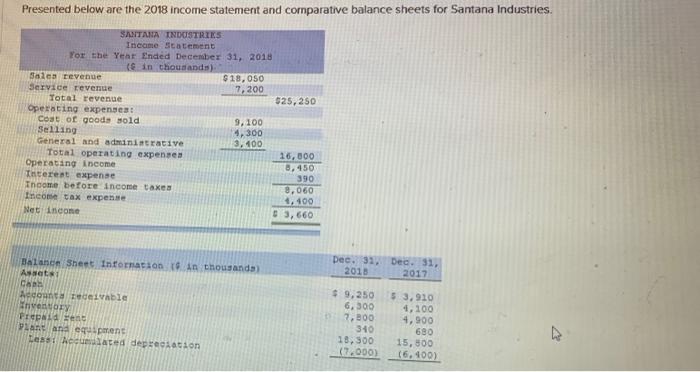

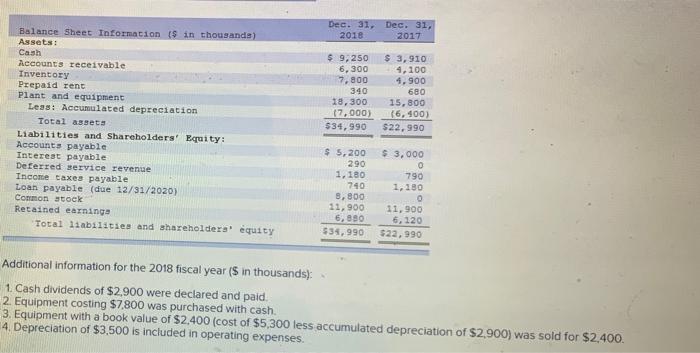

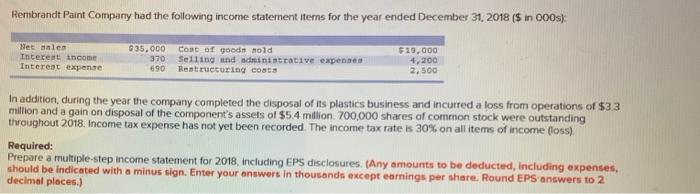

Presented below are the 2018 income statement and comparative balance sheets for Santana Industries. SANTANA INDUSTRIES Income Statement Yor the Year Ended December 31, 2018 (in thousands) Sales revenue $18,050 Service revenue 7,200 Total revenue 25,250 Operating expenses: Coat of goods sold 9, 100 Selling 4,300 General and administrative 3.100 Total operating expenses 16,000 Operating income 8.450 Interest expense 390 Income before income taxes 8,060 Income tax expense 1,400 Net Income 0 3,660 Dec. 31, Dec. 31, 2018 2017 Balance Sheet Information in thousands Assets CA Accounts receivable Inventory Prepaid rent Want as een Less! Neculated depreciation $ 9,250 6,300 7.300 340 18. 300 (7.000) 5 3.910 4,100 4,900 680 15,800 16,400) V Dec. 31, Dec. 31, 2018 2017 Balance Sheet Information ($ in thousands) Assets: Cash Accounts receivable Inventory Prepaid rent Plant and equipment Less: Accumulated depreciation Total assets Liabilities and Shareholders' Equity: Accounts payable Interest payable Deferred service revenue Income taxes payable Loan payable (due 12/31/2020) Common stock Retained earnings Total liabilities and shareholders' equity $ 9,250 6. 300 7.800 340 18,300 (7.000) $34,990 $ 3, 910 4,100 4.900 680 15,800 (6,400) $22.990 $ 5,209 290 1,180 740 8,800 11, 900 6,899 $34,990 $ 3.000 0 790 1. 180 0 11,900 6, 120 $22.990 Additional information for the 2018 fiscal year is in thousands): 1. Cash dividends of $2,900 were declared and paid. 2. Equipment costing $7,800 was purchased with cash. 3. Equipment with a book value of $2.400 (cost of $5,300 less accumulated depreciation of $2,900) was sold for $2.400. 4 Depreciation of $3,500 is included in operating expenses. Required: Prepare Santana Industries 2018 statement of cash flows, using the indirect method to present cash flows from operating activities. Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands.) SANTANA INDUSTRIES Statement of Cash Flows For the Year Ended December 31, 2018 (5 in thousands) Rembrandt Paint Company had the following income statement items for the year ended December 31, 2018 ($ in 00s) Net sales Interest income Interest expense $35.000 370 Coat of goods Hold Selling and administrative expenses Restructuring costs $19,000 4,200 2.500 690 In addition during the year the company completed the disposal of its plastkes business and incurred a loss from operations of $33 million and a gain on disposal of the component's assets of $5.4 million 700,000 shares of common stock were outstanding throughout 2018. Income tax expense has not yet been recorded. The income tax rate is 30% on all items of income foss) Required: Prepare a multiple-step income statement for 2018, including EPS disclosures (Any amounts to be deducted, including expenses, should be indicated with a minus sign. Enter your answers in thousands except earnings per share. Round EPS answers to 2 decimal places.) Prepare a multiple-step income statement for 2018, including EPS disclosures (Any amounts to be deducted, including expenses. should be indicated with a minus sign. Enter your answers in thousands except earnings per share. Round EPS answers to 2 decimal places.) REMBRANDT PAINT COMPANY Income Statement For the Year Ended December 31, 2018 15 in thousands, except per share amounts) Earnings per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts