Question: Please show all work Problem # 1 Monthly return data are presented below for each of the two stocks and the S&P index for a

Please show all work

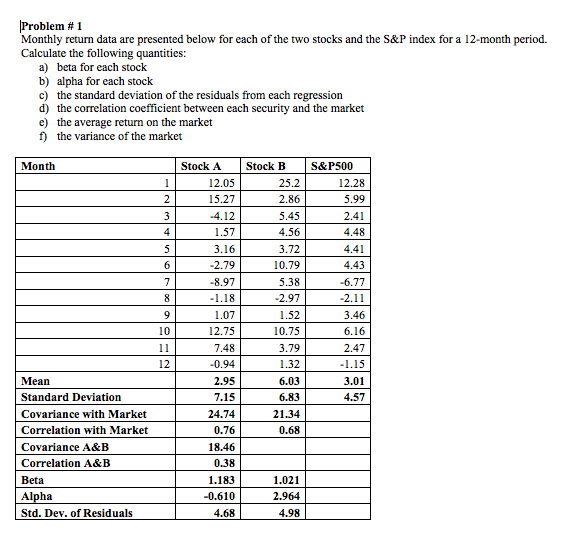

Problem # 1 Monthly return data are presented below for each of the two stocks and the S&P index for a 12-month period. Calculate the following quantities: a) beta for each stock b) alpha for each stock c) the standard deviation of the residuals from each regression d) the correlation coefficient between each security and the market e) th f) the variance of the market e average return on the market Month Stock A Stock B S&P500 12.05 15.27 4.12 1.57 3.16 2.79 -8.97 1.18 1.07 12.75 7.48 0.94 2.95 7.15 24.74 0.76 18.46 0.38 1.183 0.610 4.68 25.2 2.86 5.45 4.56 3.72 10.79 5.38 2.97 1.52 10.75 3.79 1.32 6.03 6.83 21.34 0.68 12.28 5.99 2.41 4.48 4.41 4.43 6.77 2.11 3.46 6.16 2.47 1.15 3.01 4.57 10 12 Mean Standard Deviation Covariance with Market Correlation with Market Covariance A&B Correlation A&B Beta Alpha Std. Dev. of Residuals 1.021 2.964 4.98

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts