Question: please show all work Problem #3 (P/E and EPS): Tom's management team is very concerned about its company's price earnings ratio and carings per share.

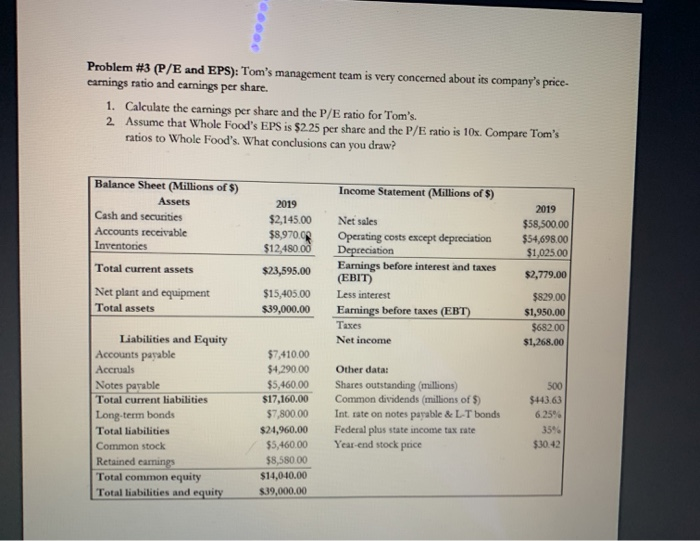

Problem #3 (P/E and EPS): Tom's management team is very concerned about its company's price earnings ratio and carings per share. 1. Calculate the earnings per share and the P/E ratio for Tom's. 2. Assume that Whole Food's EPS is $2.25 per share and the P/E ratio is 10x. Compare Tom's ratios to Whole Food's. What conclusions can you draw? Income Statement (Millions of $) Balance Sheet (Millions of $) Assets Cash and securities Accounts receivable Inventories 2019 $2,145.00 $8,970.09 $12,480.00 Total current assets Net sales Operating costs except depreciation Depreciation Earnings before interest and taxes (EBIT) Less interest Earnings before taxes (EBT) Taxes Net income $23,595.00 $15,405.00 $39,000.00 2019 $58,500.00 $54,698.00 $1,025.00 $2,779.00 $829.00 $1,950.00 $682.00 $1,268.00 Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock Retained camnings Total common equity Total liabilities and equity $7,410.00 $4,290.00 $5,460.00 $17,160.00 $7,800.00 $24,960.00 $5,460.00 $8,580.00 $14,0-10.00 $39,000.00 Other data: Shares outstanding (millions) Common dividends millions of 5) Intrate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price 500 $143.63 6.25% 35% $30.42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts