Question: Please show all work Problem: Absorption vs Variable Costing 0 38 t lo The Lawn Furniture Manufacturing Company has no inventories of any type on

Please show all work

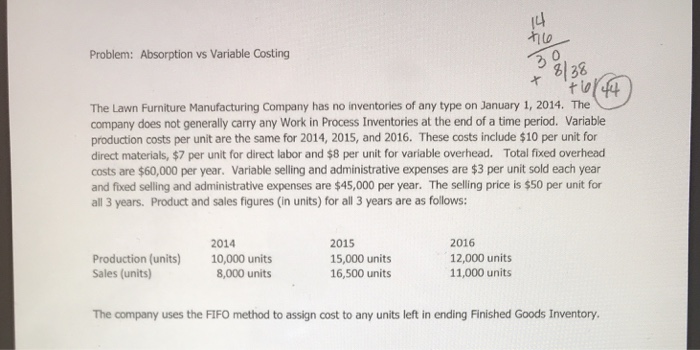

Please show all work Problem: Absorption vs Variable Costing 0 38 t lo The Lawn Furniture Manufacturing Company has no inventories of any type on January 1, 2014. The company does not generally carry any Work in Process Inventories at the end of a time period. Variable production costs per unit are the same for 2014, 2015, and 2016. These costs include $10 per unit for direct materials, $7 per unit for direct labor and $8 per unit for variable overhead. Total fixed overhead costs are $60,000 per year. Variable selling and administrative expenses are $3 per unit sold each year and fixed selling and administrative expenses are $45,000 per year. The selling price is $50 per unit for all 3 years. Product and sales figures (in units) for all 3 years are as follows: Production (units) Sales (units) 2014 10,000 units 8,000 units 2015 15,000 units 16,500 units 2016 12,000 units 11,000 units The company uses the FIFO method to assign cost to any units left in ending Finished Goods Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts