Question: please show all work Question 1 USF Inc. had an earnings before interest, taxes, and depreciation of $637 million with depreciation amounting to $235 million

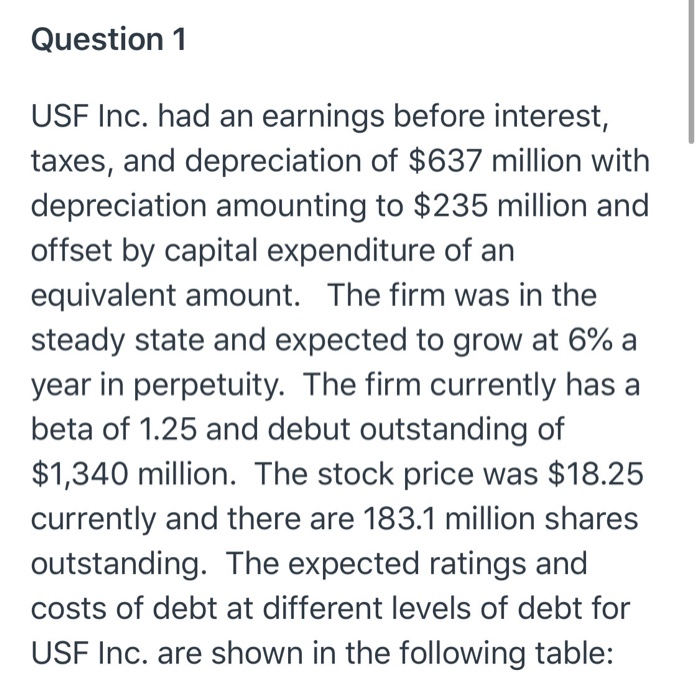

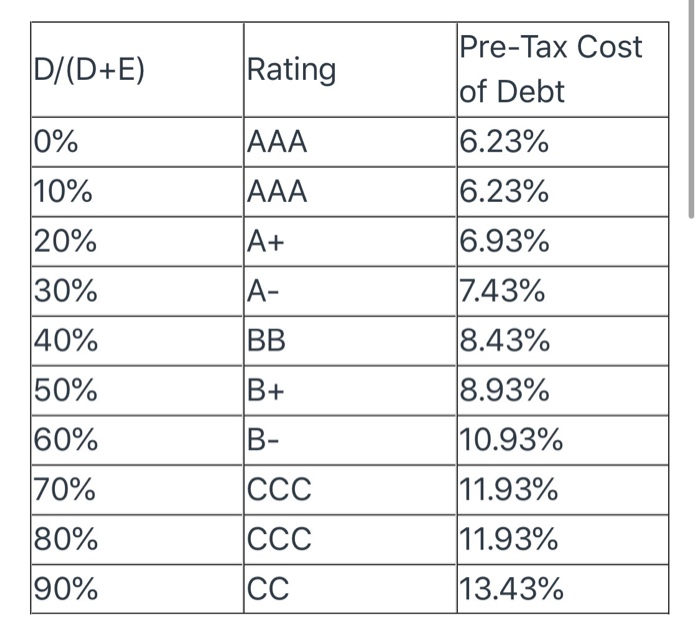

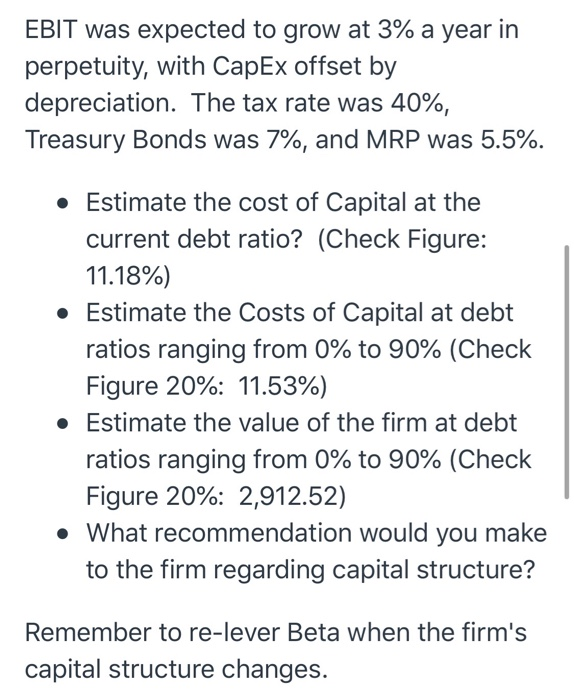

Question 1 USF Inc. had an earnings before interest, taxes, and depreciation of $637 million with depreciation amounting to $235 million and offset by capital expenditure of an equivalent amount. The firm was in the steady state and expected to grow at 6% a year in perpetuity. The firm currently has a beta of 1.25 and debut outstanding of $1,340 million. The stock price was $18.25 currently and there are 183.1 million shares outstanding. The expected ratings and costs of debt at different levels of debt for USF Inc. are shown in the following table: D/(D+E) Rating |0% |10% 20% 30% + - Pre-Tax Cost of Debt 6.23% 6.23% 6.93% 7.43% 8.43% 8.93% 10.93% 11.93% |11.93% 13.43% 40% B + - 50% 60% 70% 80% 90% CCC CC EBIT was expected to grow at 3% a year in perpetuity, with CapEx offset by depreciation. The tax rate was 40%, Treasury Bonds was 7%, and MRP was 5.5%. Estimate the cost of Capital at the current debt ratio? (Check Figure: 11.18%) Estimate the Costs of Capital at debt ratios ranging from 0% to 90% (Check Figure 20%: 11.53%) Estimate the value of the firm at debt ratios ranging from 0% to 90% (Check Figure 20%: 2,912.52) What recommendation would you make to the firm regarding capital structure? Remember to re-lever Beta when the firm's capital structure changes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts