Question: Please show all work. QUESTION 10 1 points Saved Deep Mines has 14 million shares of common stock outstanding with a beta of 1.15 and

Please show all work.

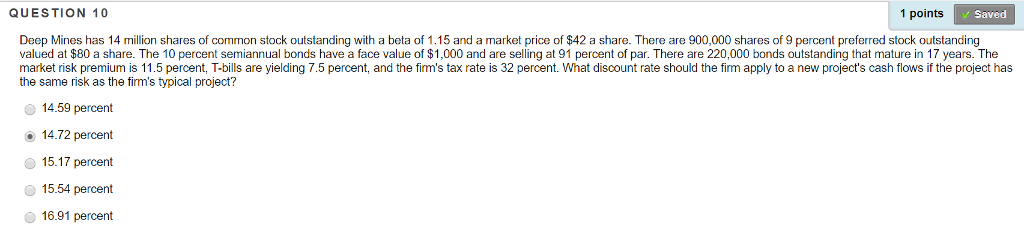

QUESTION 10 1 points Saved Deep Mines has 14 million shares of common stock outstanding with a beta of 1.15 and a market price of $42 a share. There are 900,000 shares of 9 percent preferred stock outstanding valued at $80 a share. The 10 percent semiannual bonds have a face value of $1,000 and are selling at 91 percent of par. There are 220,000 bonds outstanding that mature in 17 years. The market risk premium is 11.5 percent, T-bills are yielding 7.5 percent, and the firm's tax rate is 32 percent. What discount rate should the firm apply to a new project's cash flows if the project has the same risk as the firm's typical project? 14.59 percent 14.72 percent 15.17 percent 15.54 percent 16.91 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts