Question: please show all work step by step 7 (10 Points) CHOOSING THE BEST ALTERNATIVE 7.1. The cash flows for four mutually exclusive alternatives are provided

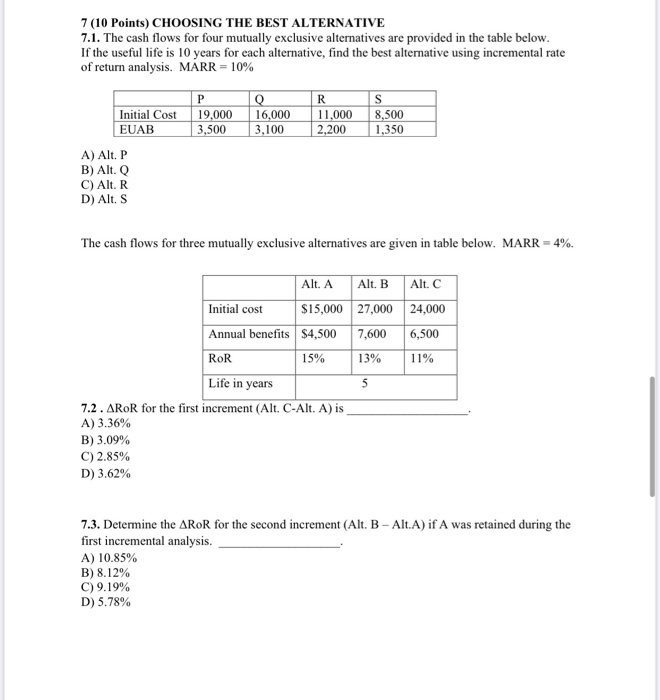

7 (10 Points) CHOOSING THE BEST ALTERNATIVE 7.1. The cash flows for four mutually exclusive alternatives are provided in the table below. If the useful life is 10 years for each alternative, find the best alternative using incremental rate of return analysis. MARR = 10% Initial Cost EUAB QR 19.000 16.000 11.000 3,500 3,100 2,200 8,500 1,350 A) Alt. P B) Alt.Q C) Alt. R D) Alt. S The cash flows for three mutually exclusive alternatives are given in table below. MARR - 4%. Alt. A Initial cost $15,000 Annual benefits $4,500 ROR 15% Life in years Alt. B 27,000 7,600 13% Alt. C 24,000 6,500 11% 7.2. AROR for the first increment (Alt. C-Alt. A) is A) 3.36% B) 3.09% C) 2.85% D) 3.62% 7.3. Determine the AROR for the second increment (Alt. B - Alt.A) if A was retained during the first incremental analysis. A) 10.85% B) 8.12% C) 9.19% D) 5.78%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts