Question: PLEASE SHOW ALL WORK! THANK YOU!!! Chapter 2 6. Olive Corp. has current assets of $15,000, net fixed assets of $13,500, current liabilities of $5,000,

PLEASE SHOW ALL WORK! THANK YOU!!!

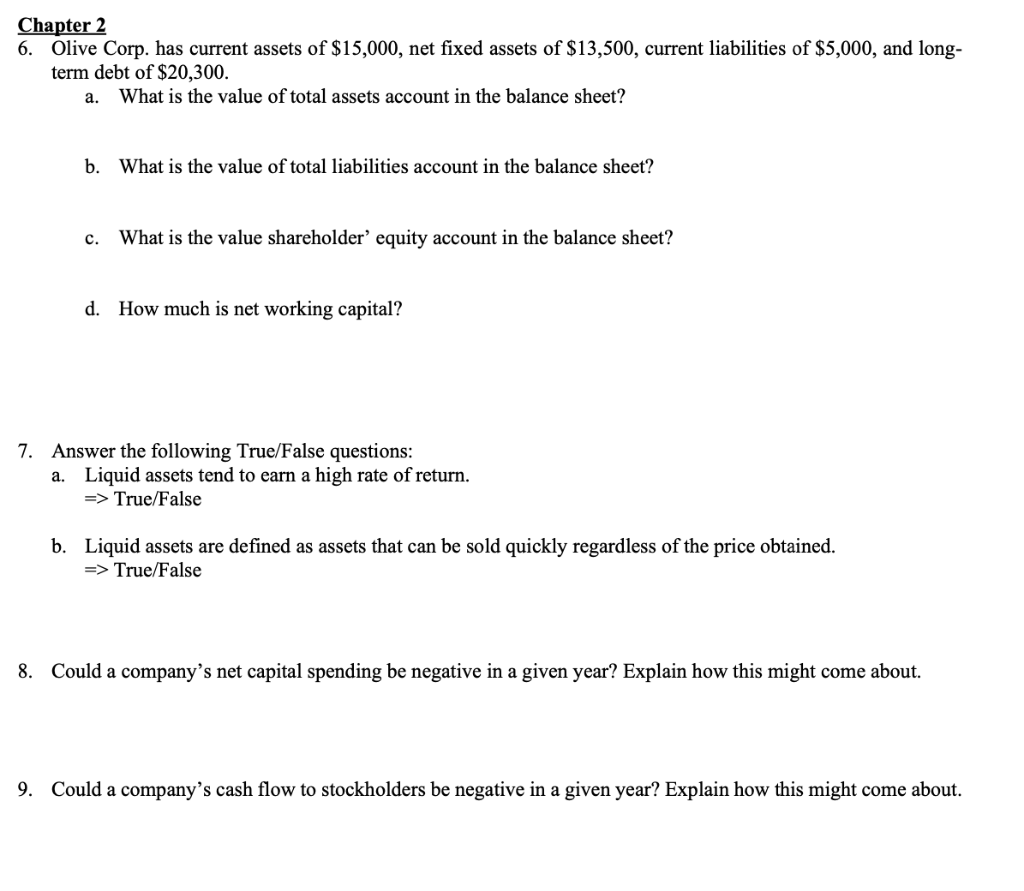

Chapter 2 6. Olive Corp. has current assets of $15,000, net fixed assets of $13,500, current liabilities of $5,000, and long- term debt of $20,300. a. What is the value of total assets account in the balance sheet? b. What is the value of total liabilities account in the balance sheet? c. What is the value shareholder' equity account in the balance sheet? d. How much is net working capital? 7. Answer the following True/False questions: a. Liquid assets tend to earn a high rate of return. => True/False b. Liquid assets are defined as assets that can be sold quickly regardless of the price obtained. => True/False 8. Could a company's net capital spending be negative in a given year? Explain how this might come about. 9. Could a company's cash flow to stockholders be negative in a given year? Explain how this might come about. Chapter 2 6. Olive Corp. has current assets of $15,000, net fixed assets of $13,500, current liabilities of $5,000, and long- term debt of $20,300. a. What is the value of total assets account in the balance sheet? b. What is the value of total liabilities account in the balance sheet? c. What is the value shareholder' equity account in the balance sheet? d. How much is net working capital? 7. Answer the following True/False questions: a. Liquid assets tend to earn a high rate of return. => True/False b. Liquid assets are defined as assets that can be sold quickly regardless of the price obtained. => True/False 8. Could a company's net capital spending be negative in a given year? Explain how this might come about. 9. Could a company's cash flow to stockholders be negative in a given year? Explain how this might come about

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts