Question: PLEASE SHOW ALL WORK!!! THANK YOU! Chapter 8 1. Drip Co. just paid a dividend of $2.00 per share. The dividends are expected to grow

PLEASE SHOW ALL WORK!!! THANK YOU!

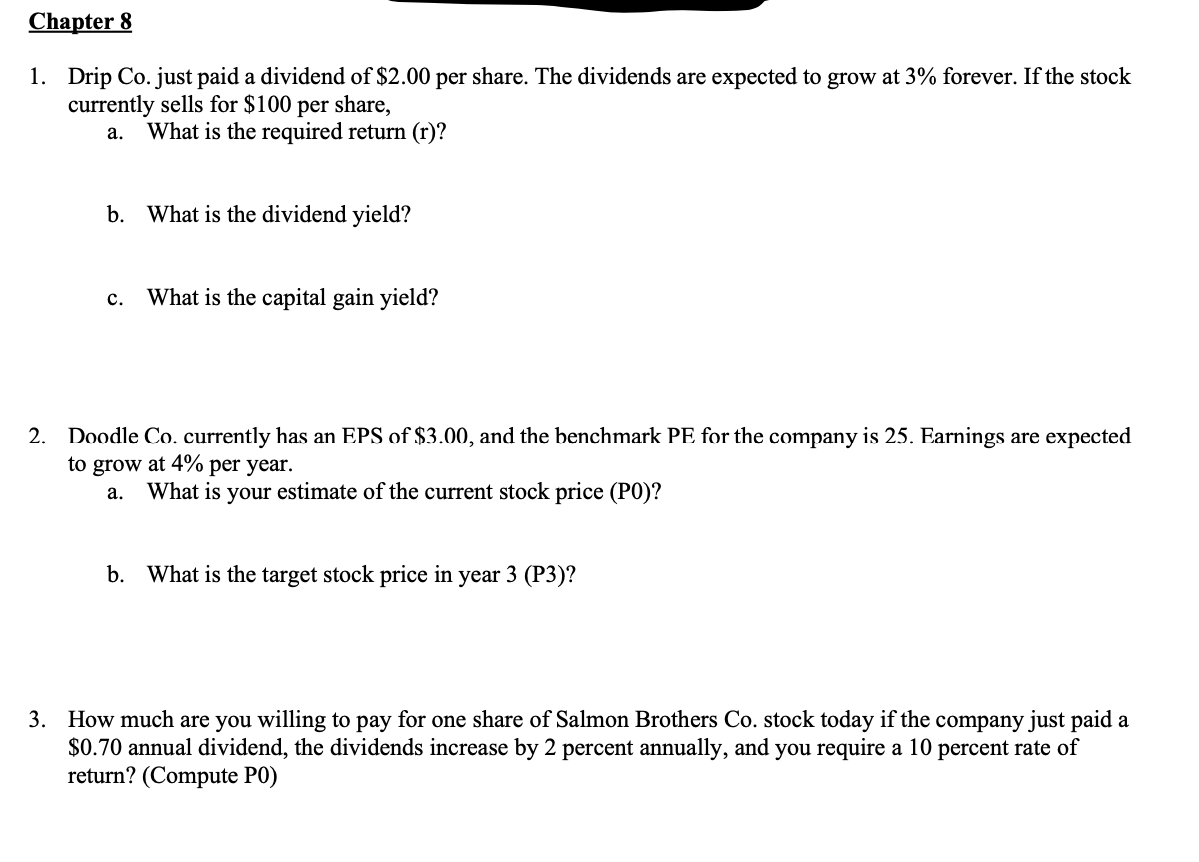

Chapter 8 1. Drip Co. just paid a dividend of $2.00 per share. The dividends are expected to grow at 3% forever. If the stock currently sells for $100 per share, What is the required return (r)? a. b. What is the dividend yield? c. What is the capital gain yield? 2. Doodle Co. currently has an EPS of $3.00, and the benchmark PE for the company is 25. Earnings are expected to grow at 4% per year. What is your estimate of the current stock price (PO)? a. b. What is the target stock price in year 3 (P3)? 3. How much are you willing to pay for one share of Salmon Brothers Co. stock today if the company just paid a $0.70 annual dividend, the dividends increase by 2 percent annually, and you require a 10 percent rate of return? (Compute PO)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts