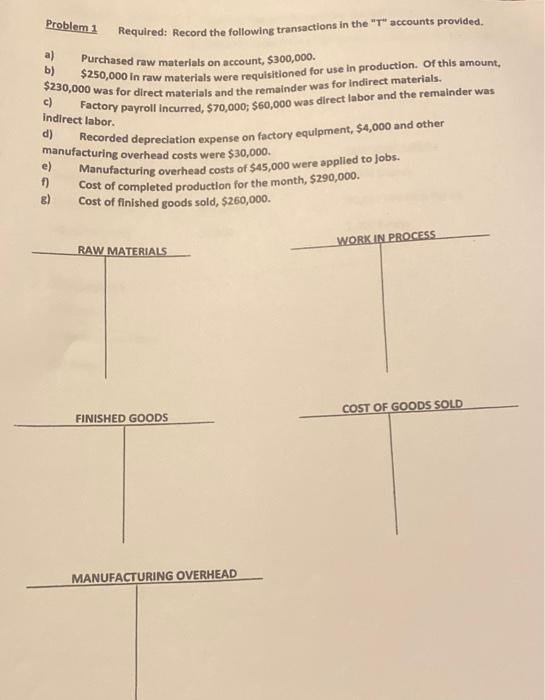

Question: please show all work. thank you! Problem Required: Record the following transactions in the T accounts provided. a) b) Purchased raw materials on account, $300,000.

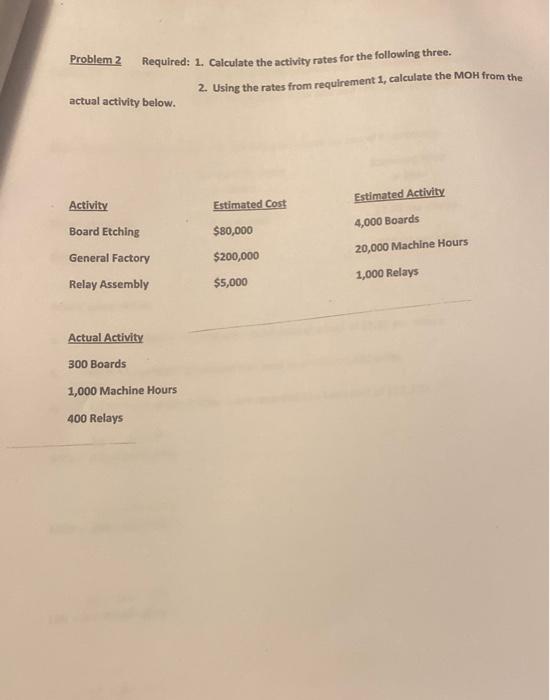

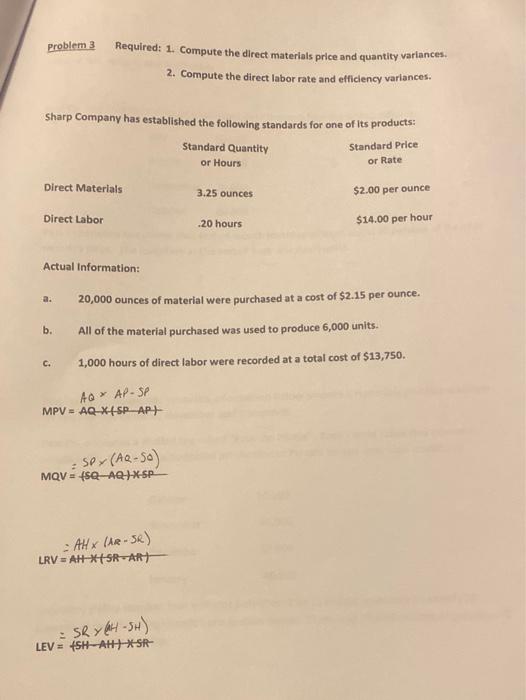

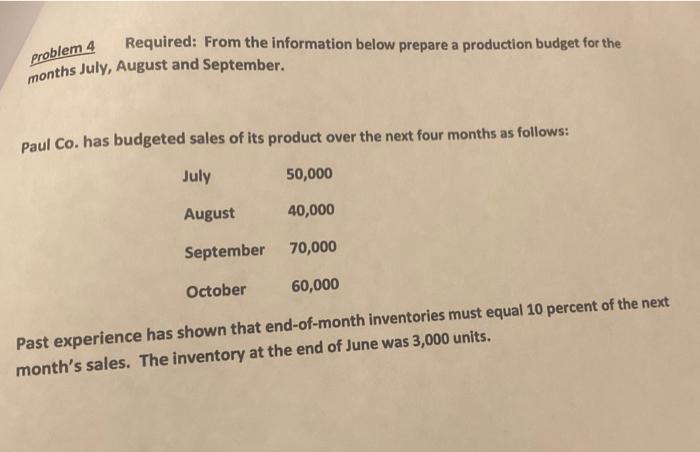

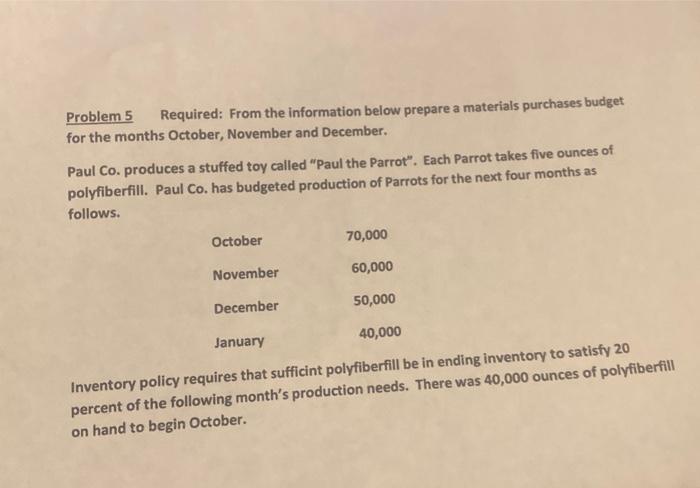

Problem Required: Record the following transactions in the "T" accounts provided. a) b) Purchased raw materials on account, $300,000. $230,000 was for direct materials and the remainder was for indirect materials $250,000 in raw materials were requisitioned for use in production. Of this amount, Factory payroll incurred, $70,000; $60,000 was direct labor and the remainder was manufacturing overhead costs were $30,000 Recorded depreciation expense on factory equipment, $4,000 and other e) Manufacturing overhead costs of $45,000 were applied to jobs. f) Cost of completed production for the month, $290,000. B) Cost of finished goods sold, $260,000. c) Indirect labor d) WORK IN PROCESS RAW MATERIALS COST OF GOODS SOLD FINISHED GOODS MANUFACTURING OVERHEAD Problem 2 Required: 1. Calculate the activity rates for the following three. 2. Using the rates from requirement 1, calculate the MoH from the actual activity below. Activity Estimated Cost Board Etching General Factory Relay Assembly $80,000 $200,000 $5,000 Estimated Activity 4,000 Boards 20,000 Machine Hours 1,000 Relays Actual Activity 300 Boards 1,000 Machine Hours 400 Relays Problem 3 Required: 1. Compute the direct materials price and quantity variances. 2. Compute the direct labor rate and efficiency variances. Sharp Company has established the following standards for one of its products: Standard Quantity Standard Price or Rate or Hours Direct Materials 3.25 ounces $2.00 per ounce Direct Labor .20 hours $14.00 per hour Actual Information: a. b. 20,000 ounces of material were purchased at a cost of $2.15 per ounce. All of the material purchased was used to produce 6,000 units. 1,000 hours of direct labor were recorded at a total cost of $13,750. C. AQ x AP-SP MPV = AQ-X4 SP-APH Sex (AQ-SO) MQV - 452-AQ-H-*-SP -AHX (AR-SR) LRV = AH *5R-ART = SR x H-SH) LEV = SHAHSR- Required: From the information below prepare a production budget for the Problem 4 months July, August and September. Paul Co. has budgeted sales of its product over the next four months as follows: July 50,000 August 40,000 September 70,000 October 60,000 Past experience has shown that end-of-month inventories must equal 10 percent of the next month's sales. The inventory at the end of June was 3,000 units. Problem 5 Required: From the information below prepare a materials purchases budget for the months October, November and December. Paul Co. produces a stuffed toy called "Paul the Parrot". Each Parrot takes five ounces of polyfiberfill. Paul Co. has budgeted production of Parrots for the next four months as follows. October 70,000 November 60,000 December 50,000 40,000 January Inventory policy requires that sufficint polyfiberfill be in ending inventory to satisfy 20 percent of the following month's production needs. There was 40,000 ounces of polyfiberfill on hand to begin October

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts