Question: Please show all work - thanks! A firm with an A rating plans to issue one million units of a 10 year-4% bond with face

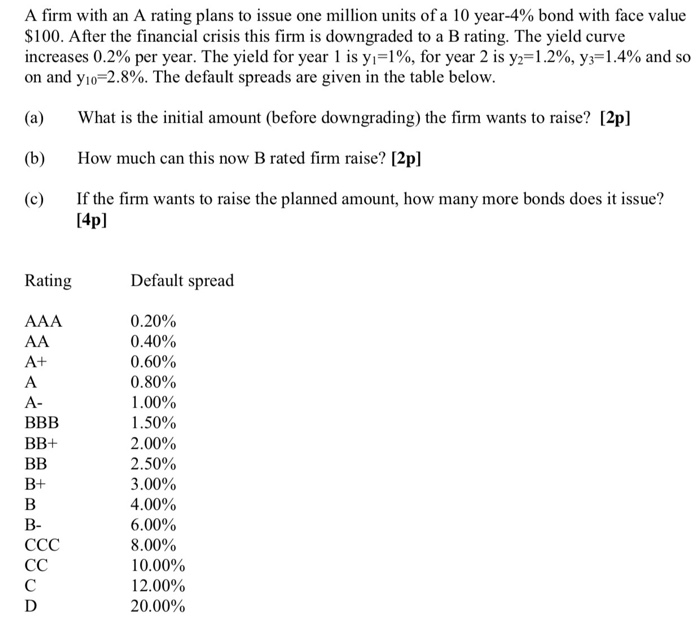

A firm with an A rating plans to issue one million units of a 10 year-4% bond with face value $100. After the financial crisis this firm is downgraded to a B rating. The yield curve increases 0.2% per year. The yield for year 1 is y1%, for year 2 is y2 1.2 %, y=1.4% and so on and yio-2.8%. The default spreads are given in the table below What is the initial amount (before downgrading) the firm wants to raise? [2p] (a) (b) How much can this now B rated firm raise? [2p] If the firm wants to raise the planned amount, how many more bonds does it issue? [4p] (c) Default spread Rating 0.20% 0.40% 0.60% 0.80% AAA AA A+ 1.00% A- B 1.50% B+ 2.00% 2.50% 3.00% + 4.00% - 6.00% 8.00% 10.00% 12.00% 20.00% D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts