Question: Please show all work. Thanks for your help!! Problem An asset used in a four-year project falls in the five-year MACRS class for tax purposes.

Please show all work. Thanks for your help!!

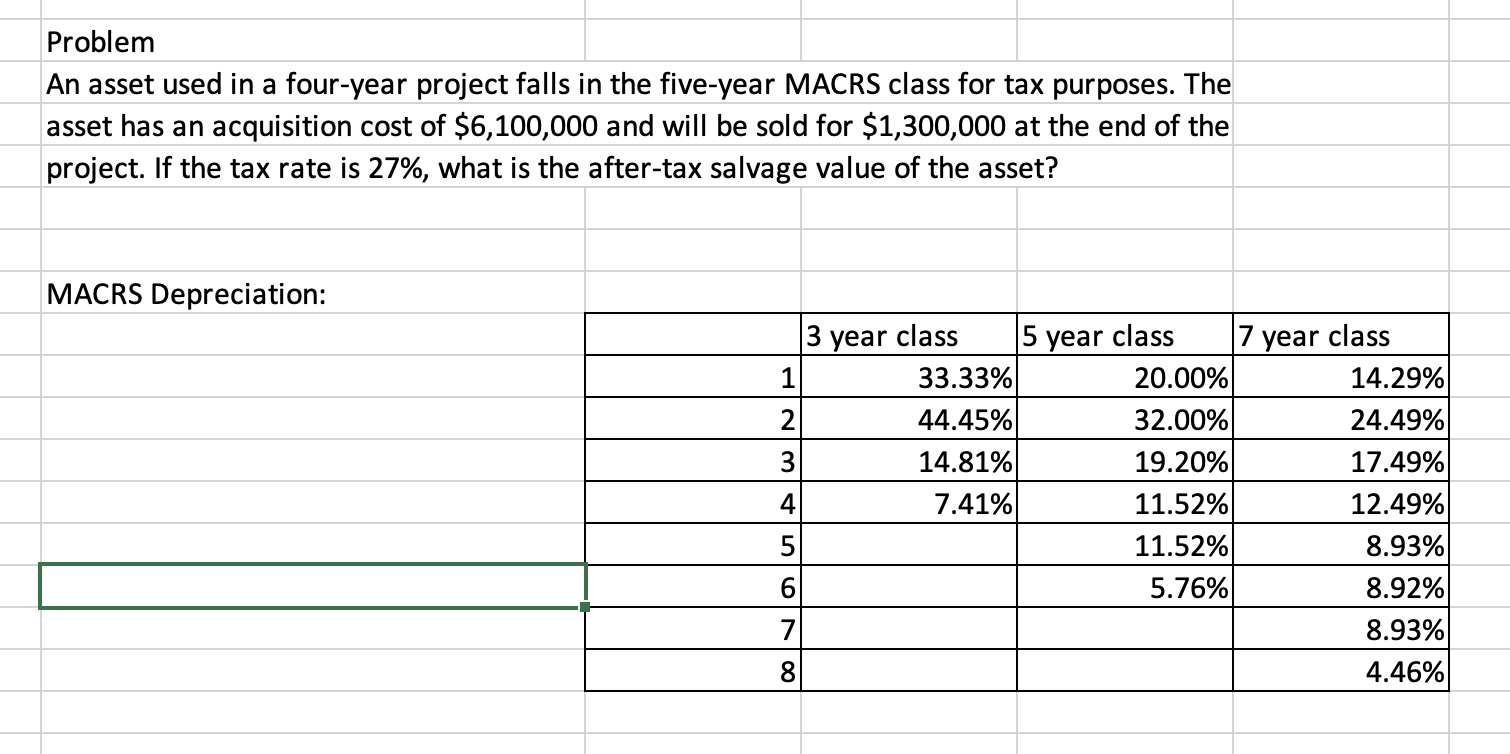

Problem An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6,100,000 and will be sold for $1,300,000 at the end of the project. If the tax rate is 27%, what is the after-tax salvage value of the asset? MACRS Depreciation: \begin{tabular}{|r|r|r|r|} \hline & 3 year class & 5 year class & 7 year class \\ \hline 1 & 33.33% & 20.00% & 14.29% \\ \hline 2 & 44.45% & 32.00% & 24.49% \\ \hline 3 & 14.81% & 19.20% & 17.49% \\ \hline 4 & 7.41% & 11.52% & 12.49% \\ \hline 5 & & 11.52% & 8.93% \\ \hline 6 & & 5.76% & 8.92% \\ \hline 7 & & & 8.93% \\ \hline 8 & & & 4.46% \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts