Question: Please show all work. The following information is given for the European call option on Schlumberger (SLB). Current Stock Price = $86.89, Strike Price =

Please show all work. The following information is given for the European call option on Schlumberger (SLB). Current Stock Price = $86.89, Strike Price = $90, rC=1.0% (continuously compounded interest rate), T = 19/365 = 0.0521, actual call option price = $1.21 and no cash dividend is expected by option expiration.

(a) When we select an initial implied volatility (Sigma) of 0.40, what value does the Black-Scholes model predict for the call option on SLB?

(b) If an adjustment to the initial guess of implied volatility would be needed, should we increase or decrease our initial guess?

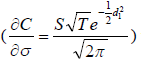

(c) Calculate the Vega,  using the initial selected volatility of 0.40.

using the initial selected volatility of 0.40.

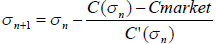

(d) Based on  , what is our new guess for the implied volatility?

, what is our new guess for the implied volatility?

(e) Calculate the implied volatility using EXCEL.

( oC ste 54 . 2 On+1 = 0 Co)-Cmarket Con) ( oC ste 54 . 2 On+1 = 0 Co)-Cmarket Con)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts