Question: Please show all work! They are both one question. Not different ones. You have a second potential project for which you want to establish the

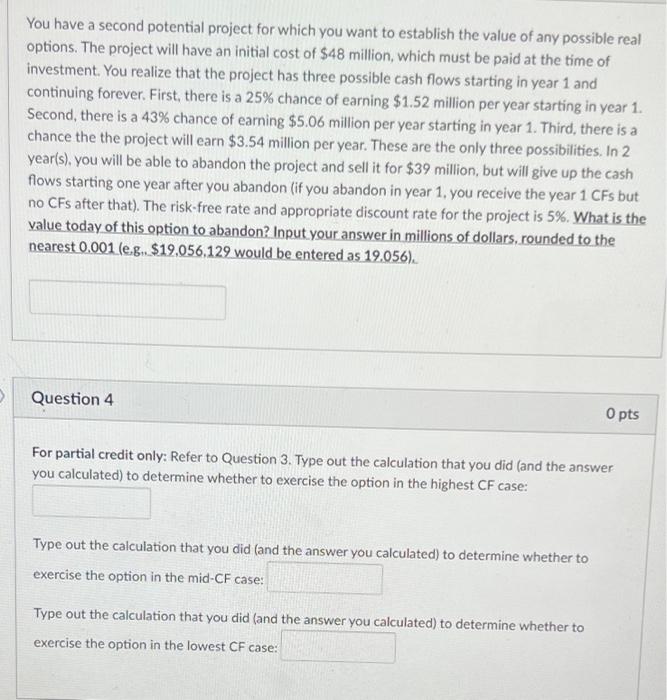

You have a second potential project for which you want to establish the value of any possible real options. The project will have an initial cost of $48 million, which must be paid at the time of investment. You realize that the project has three possible cash flows starting in year 1 and continuing forever. First, there is a 25% chance of earning $1.52 million per year starting in year 1. Second, there is a 43% chance of earning $5.06 million per year starting in year 1. Third, there is a chance the the project will earn $3.54 million per year. These are the only three possibilities. In 2 year(s), you will be able to abandon the project and sell it for $39 million, but will give up the cash flows starting one year after you abandon (if you abandon in year 1, you receive the year 1 CFs but no CFs after that). The risk-free rate and appropriate discount rate for the project is 5%. What is the value today of this option to abandon? Input your answer in millions of dollars, rounded to the nearest 0.001 (e.g. $19,056,129 would be entered as 19.056). Question 4 O pts For partial credit only: Refer to Question 3. Type out the calculation that you did (and the answer you calculated) to determine whether to exercise the option in the highest CF case: Type out the calculation that you did (and the answer you calculated) to determine whether to exercise the option in the mid-CF case: Type out the calculation that you did (and the answer you calculated) to determine whether to exerci the option in the lowest CF case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts