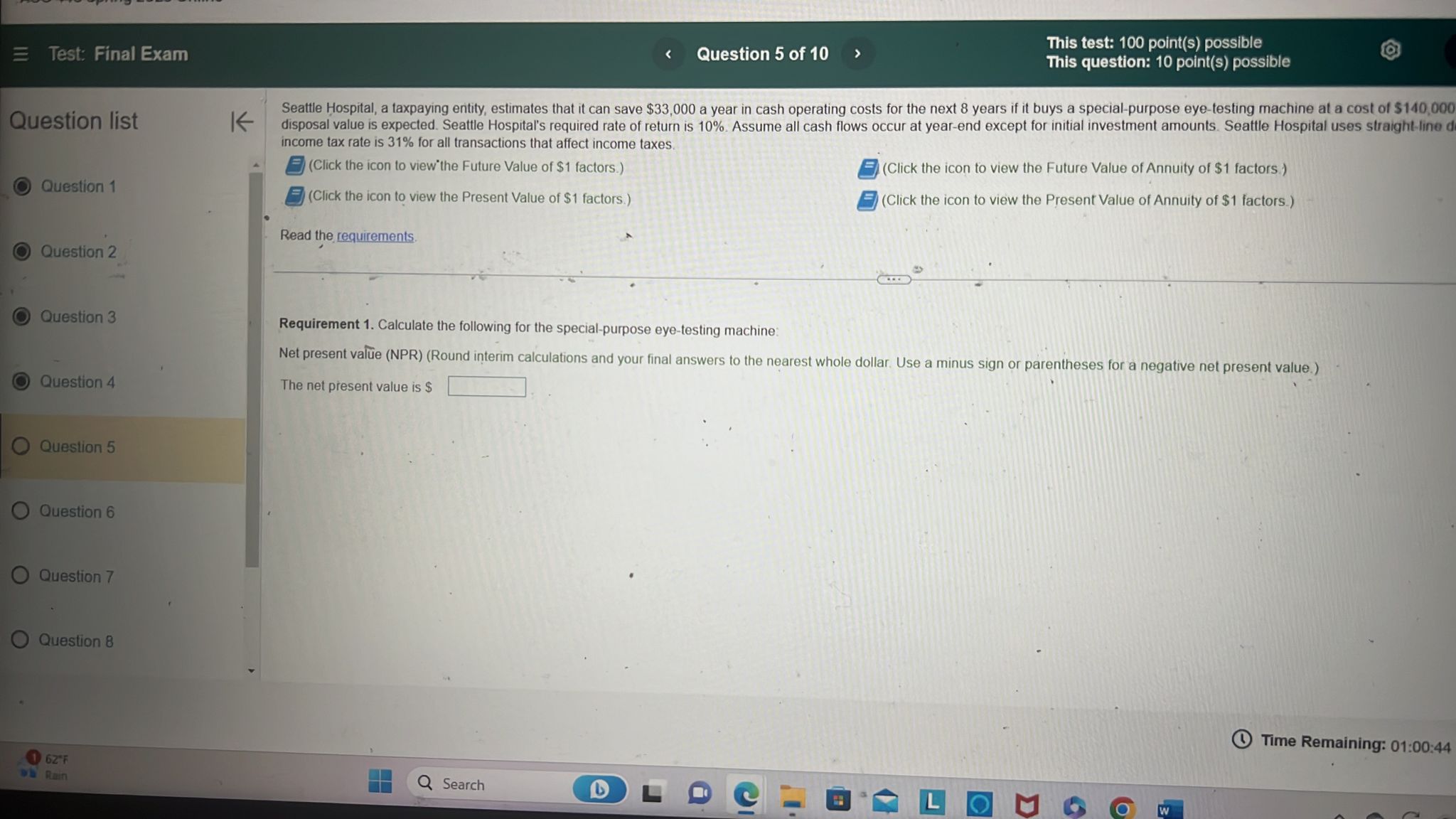

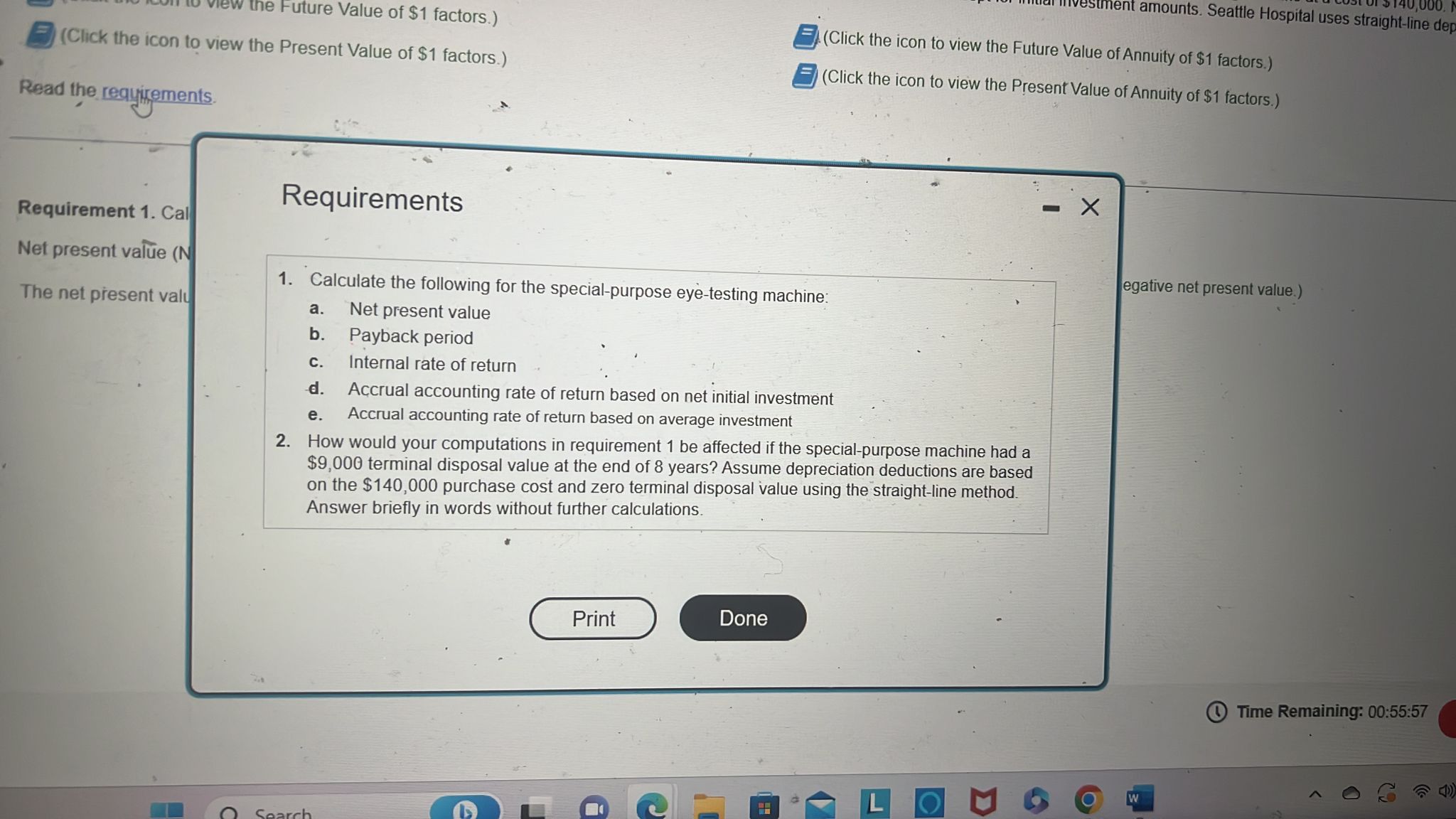

Question: PLEASE SHOW ALL WORK!!! This test: 100 point(s) possible E Test: Final Exam This question: 10 point(s) possible Seattle Hospital, a taxpaying entity, estimates that

PLEASE SHOW ALL WORK!!!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock