Question: Please Show all work to your answers this is question fivelook at the image Answer the 3 questions below showing all your work Q 3

Please Show all work to your answers this is question fivelook at the image

Answer the questions below showing all your work

Q: Assume the following information:

day US interest rate

day British interest rate

day forward rate of British pound $

Spot rate of British pound $

Assume that Riverside Corp. from the United States will receive pounds in days. Would it be better off using a forward hedge or a money market hedge? Substantiate your answer with estimated revenue for each type of hedge.

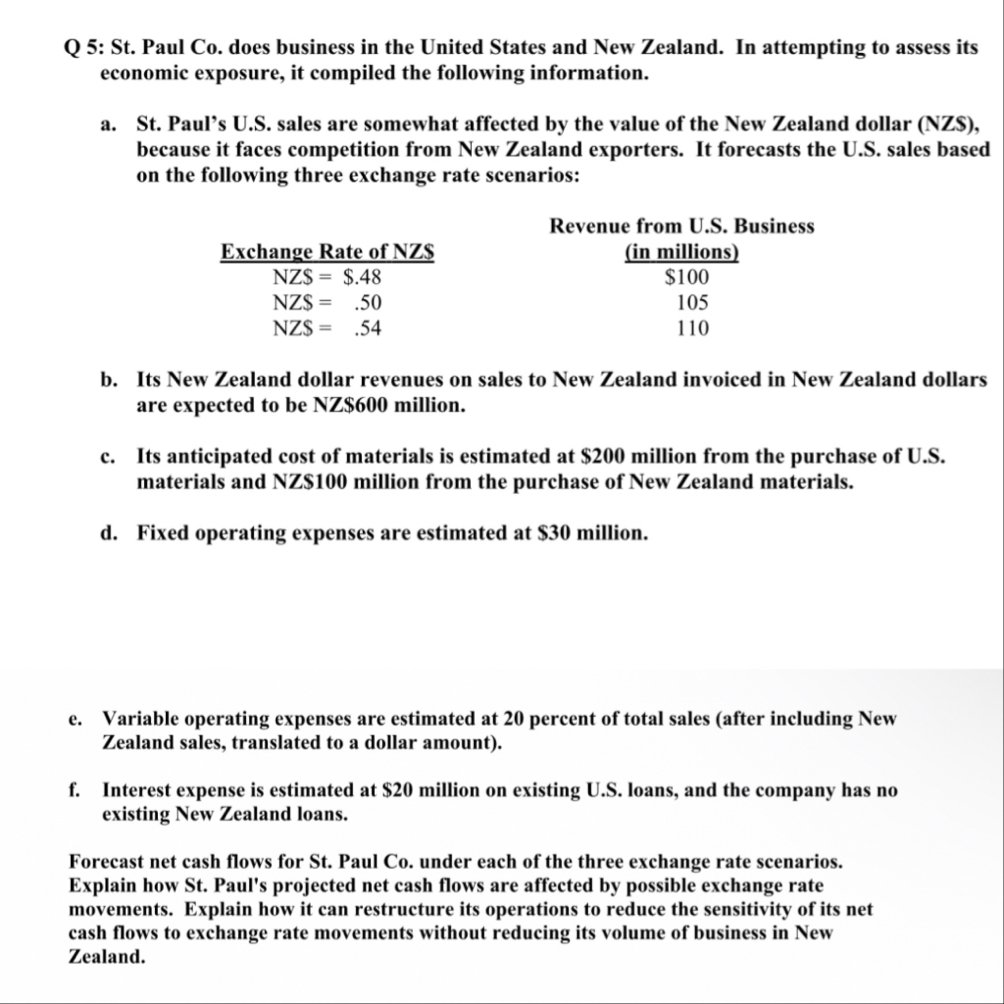

Q : Albany Corp. is a USbased MNC that has a large government contract with Australia. The contract will continue for several years and generate more than half of Albany's total sales volume. The Australian government pays Albany in Australian dollars. About percent of Albany's operating expenses are in Australian dollars; all other expenses are in US dollars. Explain how Albany Corp. can reduce its economic exposure to exchange rate fluctuations.Q : St Paul Co does business in the United States and New Zealand. In attempting to assess its economic exposure, it compiled the following information.

a St Paul's US sales are somewhat affected by the value of the New Zealand dollar NZS because it faces competition from New Zealand exporters. It forecasts the US sales based on the following three exchange rate scenarios:

tableExchange Rate of NZStablein millions$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock