Question: Please show all work. Upvotes will be given for correct answer! Q8-Consider the following data for four bonds, each of which matures at the end

Please show all work. Upvotes will be given for correct answer!

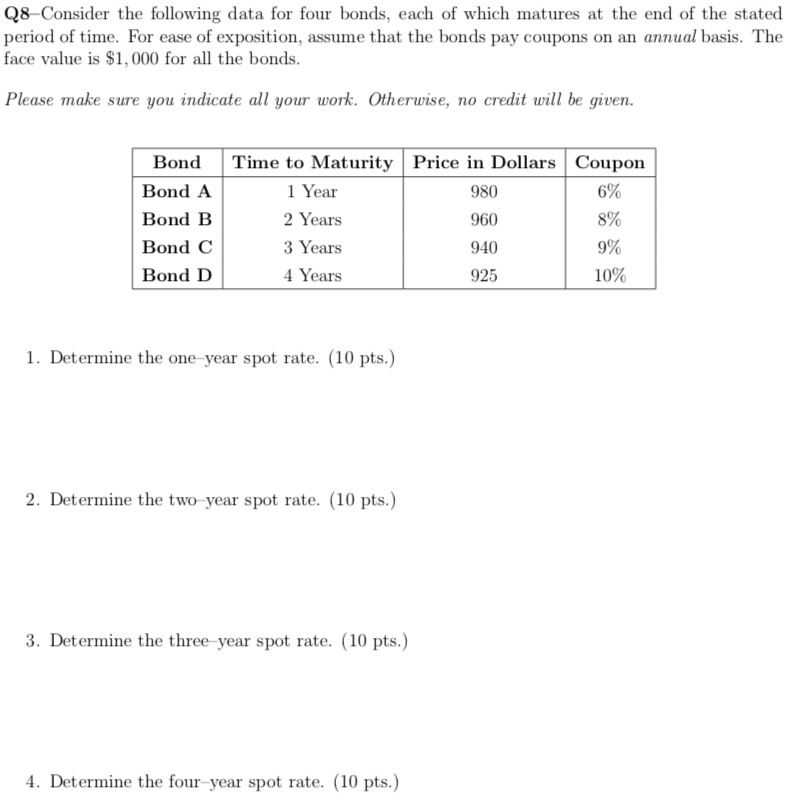

Q8-Consider the following data for four bonds, each of which matures at the end of the stated period of time. For ease of exposition, assume that the bonds pay coupons on an annual basis. The face value is $1,000 for all the bonds. Please make sure you indicate all your work. Otherwise, no credit will be given. Bond Bond A Bond B Bond C Bond D Time to Maturity Price in Dollars Coupon 1 Year 980 6% 2 Years 960 8% 3 Years 940 9% 4 Years 925 10% 1. Determine the one year spot rate. (10 pts.) 2. Determine the two year spot rate. (10 pts.) 3. Determine the three year spot rate. (10 pts.) 4. Determine the four-year spot rate. (10 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts