Question: Please show all work. Use Appendix A-D 1. The Hamptons want to have $1,750,000 for their retirement in 30 years. How much should they save

Please show all work.

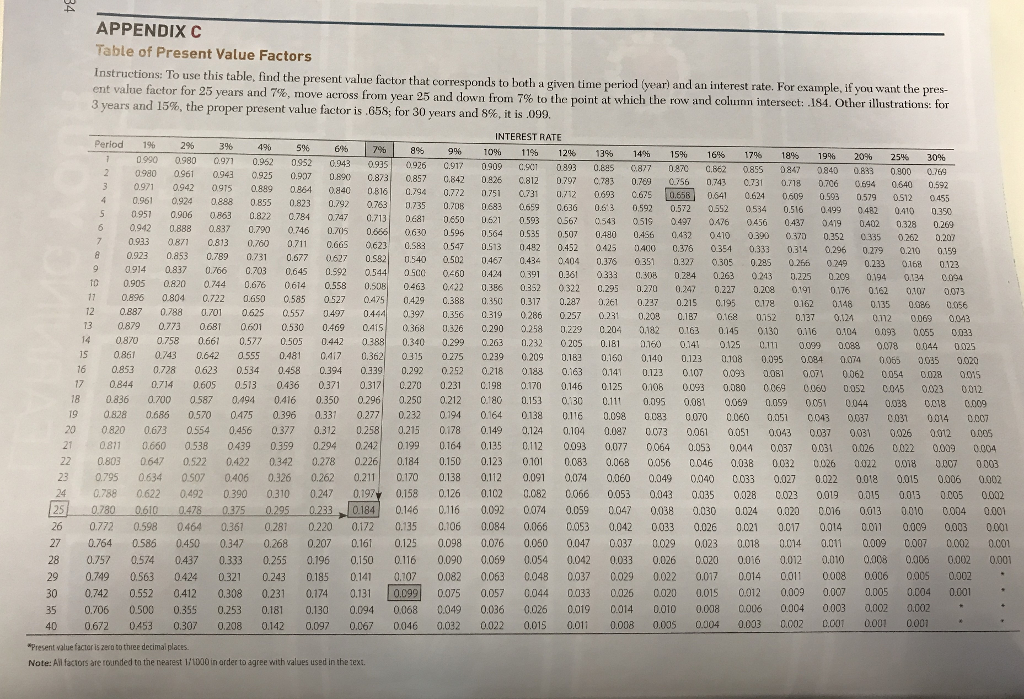

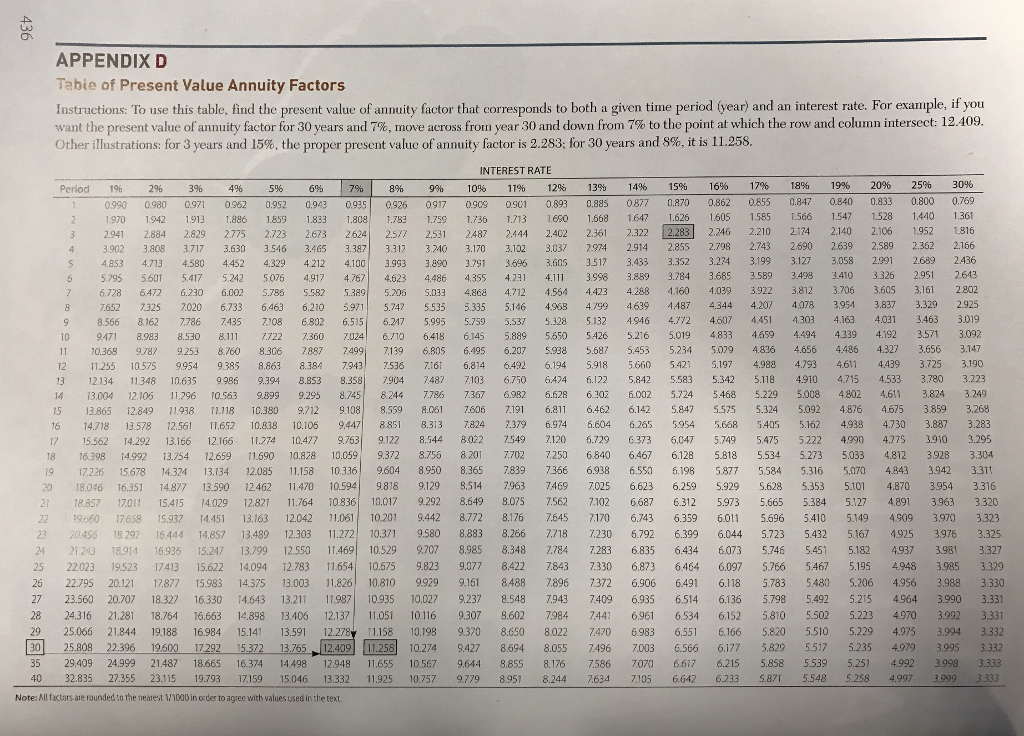

Use Appendix A-D

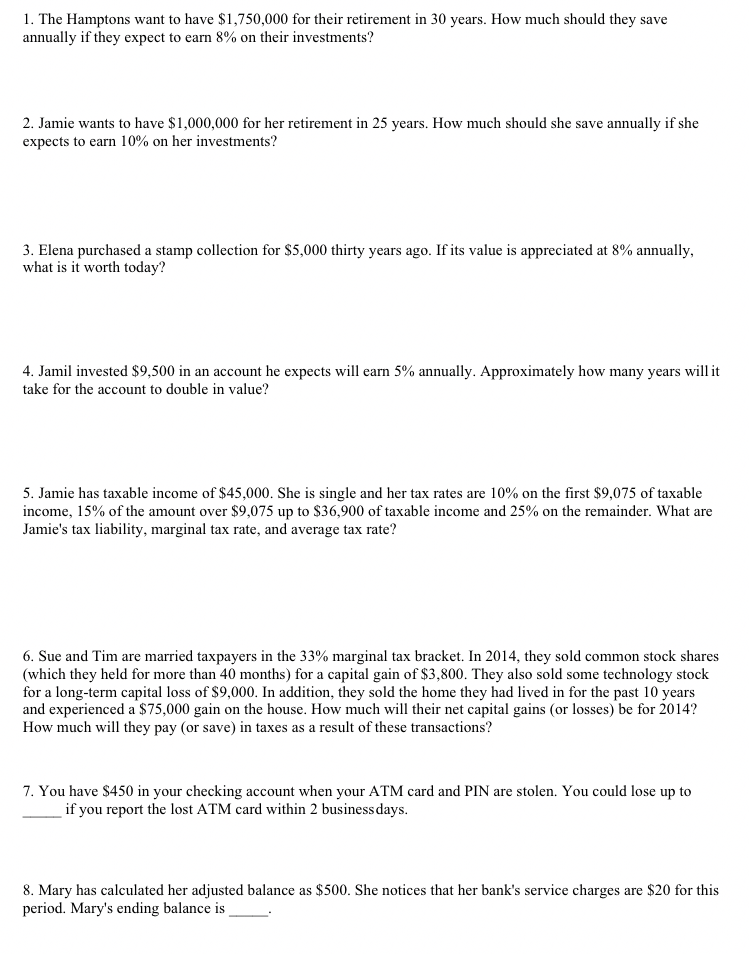

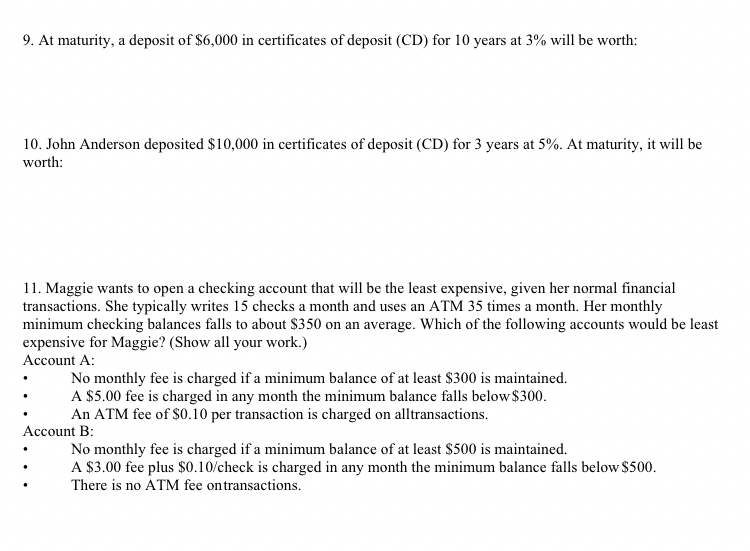

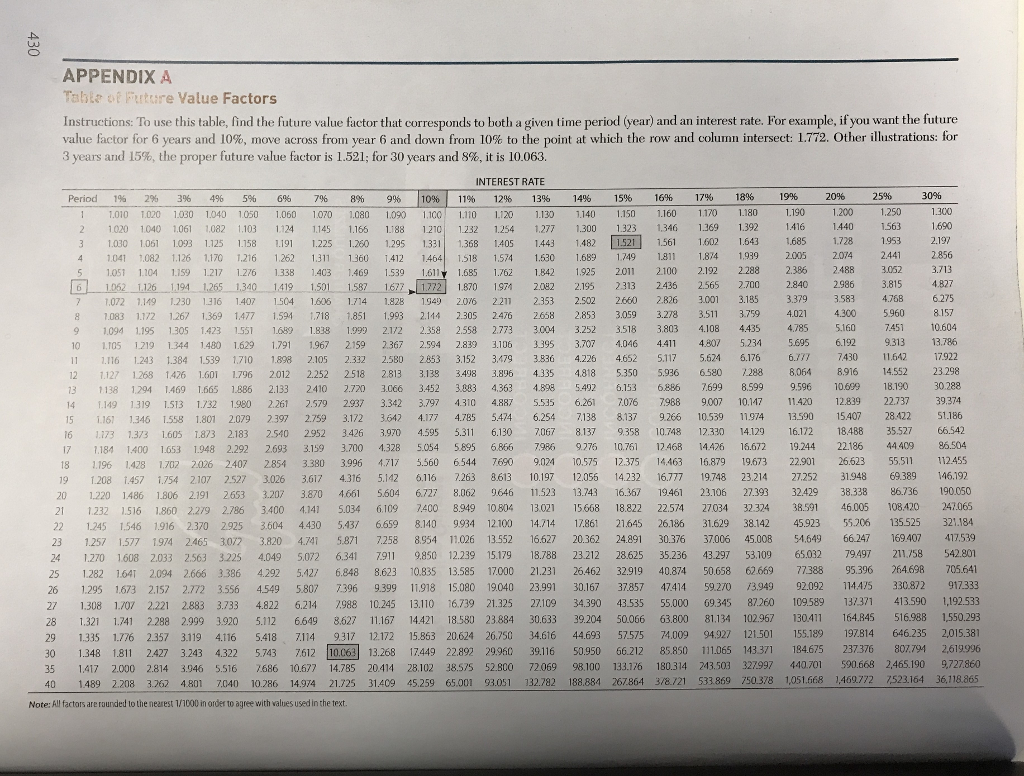

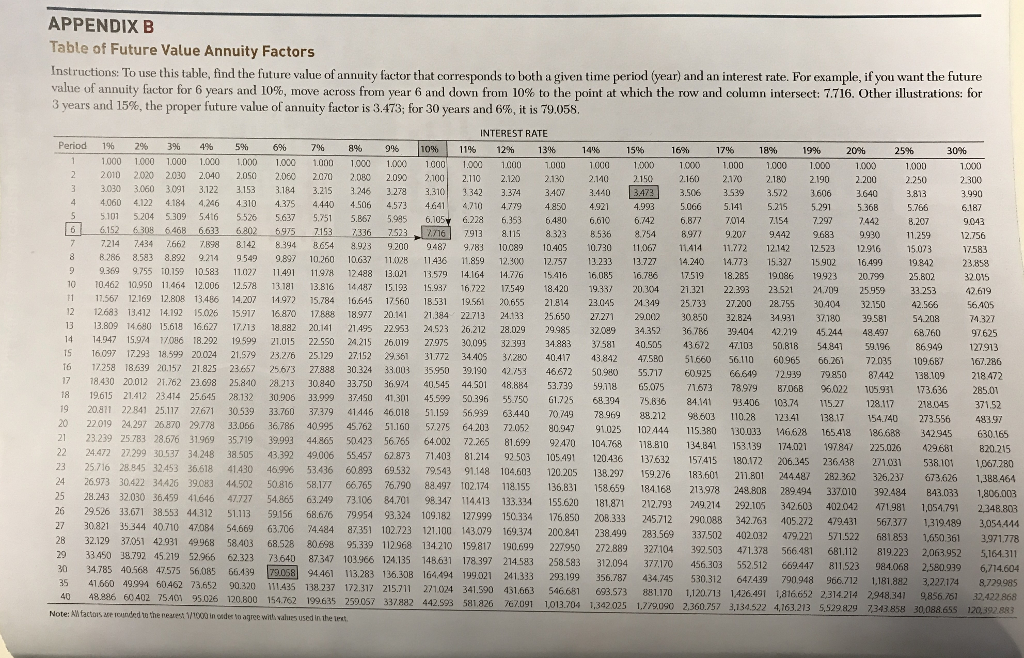

1. The Hamptons want to have $1,750,000 for their retirement in 30 years. How much should they save annually if they expect to earn 8% on their investments? 2. Jamie wants to have $1,000,000 for her retirement in 25 years. How much should she save annually if she expects to earn 10% on her investments? 3 Elena purchased a stamp collection for $5,000 thirty years ago. If its value is appreciated at 8% annually, what is it worth today? 4. Jamil invested $9,500 in an account he expects will earn 5% annually. Approximately how many years will it take for the account to double in value? 5. Jamie has taxable income of$45,000. She is single and her tax rates are 10% on the first $9,075 of taxable income, 15% of the amount over $9,075 up to $36,900 of taxable income and 25% on the remainder. What are Jamie's tax liability, marginal tax rate, and average tax rate? 6, Sue and Tim are married taxpayers in the 33% marginal tax bracket. In 2014, they sold common stock shares (which they held for more than 40 months) for a capital gain of $3,800. They also sold some technology stock for a long-term capital loss of $9,000. In addition, they sold the home they had lived in for the past 10 years and experienced a $75,000 gain on the house. How much will their net capital gains (or losses) be for 2014? How much will they pay (or save) in taxes as a result of these transactions? 7. You have $450 in your checking account when your ATM card and PIN are stolen. You could lose up to if you report the lost ATM card within 2 business days. 8. Mary has calculated her adjusted balance as $500. She notices that her bank's service charges are $20 for this period. Mary's ending balance is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts